The Missing Numbers in the Autumn Economic Forecast

Adelina Marini, November 17, 2015

The demographic component of growth is not the only novelty in this year’s economic forecast. There was one more quite important element in it, which however, due to lack of figures, remains almost invisible. It is the effect of structural reforms. This tiresome phrase, which some MEPs even wanted it taken out of the Brussels vocabulary, because it annoys, turns out to be key to EU economic growth, especially in the euro area, for the three-year forecast period (2015-2017). The autumn forecast is not as optimistic as the spring one. In spring, the Commission expected euro area economy to grow by 1.5% this year, 1.9% next year, and 2.0% towards the end of the forecast period. The EC corrected upward its expectations for this year, but the ones for next year and for 2017 went down. Real GDP in the euro area is expected to grow by 1.6% in 2015, by 1.8% next year, and by 1.9% in 2017.

The demographic component of growth is not the only novelty in this year’s economic forecast. There was one more quite important element in it, which however, due to lack of figures, remains almost invisible. It is the effect of structural reforms. This tiresome phrase, which some MEPs even wanted it taken out of the Brussels vocabulary, because it annoys, turns out to be key to EU economic growth, especially in the euro area, for the three-year forecast period (2015-2017). The autumn forecast is not as optimistic as the spring one. In spring, the Commission expected euro area economy to grow by 1.5% this year, 1.9% next year, and 2.0% towards the end of the forecast period. The EC corrected upward its expectations for this year, but the ones for next year and for 2017 went down. Real GDP in the euro area is expected to grow by 1.6% in 2015, by 1.8% next year, and by 1.9% in 2017.

Growth in countries outside the euro area is way stronger, which the EC attributes to the renewed process of catching-up in several Central and Eastern European member states. According to the analysis in the forecast, this is so because non-euro area states look less affected by the “legacy” of the crisis like unemployment and deleveraging. According to the EC, EU growth to a vast degree depends on favourable conditions, called “tailwinds” in the forecast. Those are low oil prices, the cheap euro, and the European Central Bank's flexible monetary policy. The elephant in the room is different, however. The EC feels that good times are ahead for those member states that have completed structural reforms. Two are mentioned most often – of the labour market and of the product market.

Reformist states are yet expected to start reaping the benefits of painful efforts. The EC admits that reforms done so far in the euro area as a whole and in some core countries were not sufficient to expand growth potential noticeably. Unfortunately, the EC stops there and does not name the states which backtracked or were hesitant regarding bolder reforms. Surely, France is one of them.

The forecast says countries that got hit the heaviest, but did implement a labour market reform, are expected to show growth in employment. It is expected to grow by 0.9% in the euro area during this year and next, and by 1% in 2017. In the EU in general, employment is expected to grow by 1% this year and by 0.9% in 2016 and 2017. Despite this expected growth of employment, the rate of diminishing of unemployment is too slow to drive it back to pre-crisis levels. Reform of the labour market is one of the key ones that the EC insists on in the country-specific recommendations to member states, which kept refusing to implement them for a long time, Italy and France being prime examples. Italy, however, under the leadership of young left-centrist Prime Minister Matteo Renzi took several bold steps in this direction.

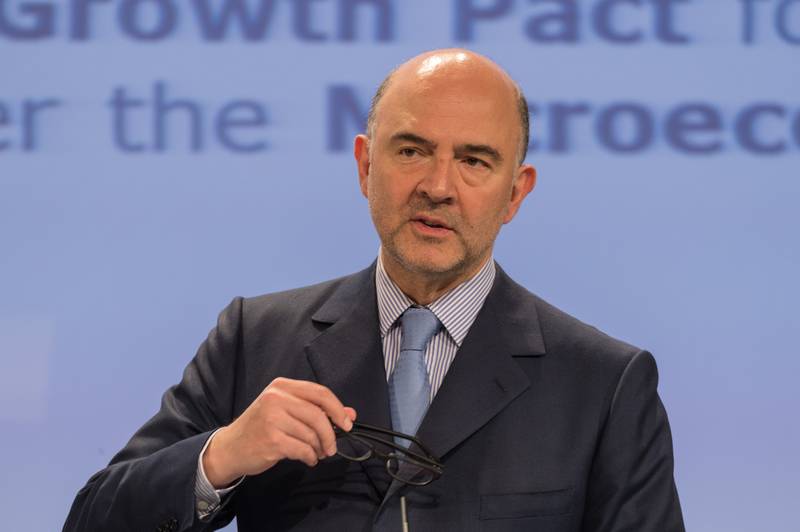

European Commissioner for Economic and Financial Affairs Pierre Moscovici (France, Socialists and Democrats) mentioned Italy at the presentation of the autumn economic forecast on November 5th as one of the countries which implemented labour market reforms and can expect increases in employment. Besides Italy, he also mentioned Greece, Spain, and Portugal. Mr Moscovici pointed out that over the following years it is expected that it would be exactly structural reforms that will turn out to be in the centre of economic growth. He warned that the strength of current tailwinds like low petrol prices, flexible monetary policy of the European Central Bank, and the low price of the euro will diminish with time. This would be the exact moment for the results of structural reforms to come up on stage.

Neither the Commissioner, nor the forecast analysis, however, take the next step to explain exactly how they expect this to happen and where are the possible risks. Will there be a gap between the dying of the “tailwinds”, meaning is there zero growth, or recession expected in states which do not implement structural reforms? Which are the most vulnerable states? Which reforms are expected to give results and when? Those are questions, whose answers are extremely important in order to stimulate hesitant governments to finally implement the long postponed reforms. So far, talk about structural reforms remains far too general. Most institutional leaders support their well-known positions that structural reforms are key to economic growth within the EU and the euro area in particular. Among them are ECB President Mario Draghi, who has been repeating this tirelessly over the past years, the boss of the permanent bailout fund (European Stability Mechanism of the euro area), Klaus Regling, Eurogroup leader Jeroen Dijsselbloem (the Netherlands, Socialists and Democrats).

During a hearing in the economic committee of the European Parliament last week ESM chief Klaus Regling repeated what he says after every meeting of the Eurogroup, especially in the context of Greece, that actually the countries that went through bailout programmes are the most reformed ones at present. Out of all five countries four are success stories. Those are Portugal, Spain, Ireland, and to some degree Cyprus, he said before MEPs. These states are named reform champions by the Organisation for Economic Co-operation and Development and the World Bank. Their economies are in much better shape than those of other states. In Spain, he went on, economic growth is expected to reach 3%. The autumn economic forecast points out that it is exactly due to labour market reforms in Spain, which led to lowering the cost of labour that lead to expectations of GDP growing more than twofold. This way Spain ranks between the fastest growing large economies.

During the entire three-year forecast period Spain is expected to have economic growth above EU average in the company of Poland, Great Britain, the Netherlands, and Germany. Spanish growth is expected to reach 2.7% in 2016, and 2.4% in 2017. Ireland is the undisputed champion again this year with expected GDP growth of 6%. Growth is expected to level out in 2016-2017 at around 4%. This brings with it a sizable decline of unemployment down to around 7% at the end of the period. Portugal too is among the states used as proof that the key is in structural reforms, although the situation there is a little different due to the already started political instability. The EC forecasts economic growth of 1.7% in Portugal for next year, and 1.8% in 2017. Cyprus is yet to feel the benefit of its bailout programme. According to the forecast, after a three-year recession Cypriot economy is expected to start growing reaching 1.4% GDP growth in 2016 and 2.0% in 2017. According to Klaus Regling, Cyprus is expected to come out of its programme in March.

Greece, however, remains a special case, said the bailout fund’s boss. Before the anti-system party SYRIZA came to power Greece was on the right track. Mr Regling reminded that Greece rose in the World Bank’s ranking for countries to do business in from 109th to 61st place. Because of the new government, however, the positive trend abruptly halted. He remained optimistic that with the new programme conditions for return to growth are now present. “Greece can only become the next success story, if it sticks to the reforms it has committed to”, said Klaus Regling (Germany). Greek economy is expected to begin growing again during the second half of 2016. Until then the economy is expected to shrink by 1.3%. Greece, however, is the most susceptible state to geopolitical risks and migration.

Regardless of scarce information on the effect of structural reforms, the fact that they are expected to pick up growth after the diminishing of the effects of oil prices and the cheap euro is still something. The question is whether the lack of serious exploration of this factor, described as key to future growth, is due to the new political outlook of the EC, or to the lack of sufficiently substantiated data. In the course of and a little after the end of the crisis the conversation on structural reforms was quite thorough and stood at the basis of talks on growth. This is precisely why structural reforms turned into the third pillar of EU economic governance. After the concessions, granted to France by the EC, Pierre Moscovici will find it  rather difficult to prove he really believes in structural reforms and their leading role in growth.

rather difficult to prove he really believes in structural reforms and their leading role in growth.

Moreover, French economy is expected to remain below the average euro area growth rate. In 2016, French GDP is expected to grow by 1.4% and in 2017 – by 1.7%. Due to lack of a brave enough reform of the labour market, the EC expects employers to continue to be cautious towards opening new jobs. Unemployment in the country hovers a little above 10% and will stay at that level for all of the forecast period. So, the main conclusion of the autumn economic forecast repeats what was being said over the last at least three years, namely that structural reforms are a booster of growth, especially during times when outside factors bring a large risk to the fulfilment of economic forecasts.

Translated by Stanimir Stoev

Klaus Regling | © Council of the EU

Klaus Regling | © Council of the EU Mario Centeno | © Council of the EU

Mario Centeno | © Council of the EU Mario Centeno | © Council of the EU

Mario Centeno | © Council of the EU