It's Not the Austerity, Stupid, It's the Structural Reforms!

Adelina Marini, May 7, 2013

It is very difficult in an environment of rapidly gaining popularity populists to conduct policy of correcting past mistakes, which usually leads to social discontent and every now and then to early elections as well. Even harder that is in the framework of a very complex organism such as the European Union. That is why, the first sign that something could have been mistaken causes serious tremors. This is precisely the case with the academic debate between the austerians and the spenders (proponents of budget constraints and those who defend more spending in support of economic growth).

It is very difficult in an environment of rapidly gaining popularity populists to conduct policy of correcting past mistakes, which usually leads to social discontent and every now and then to early elections as well. Even harder that is in the framework of a very complex organism such as the European Union. That is why, the first sign that something could have been mistaken causes serious tremors. This is precisely the case with the academic debate between the austerians and the spenders (proponents of budget constraints and those who defend more spending in support of economic growth).

Reinhart and Rogoff's error

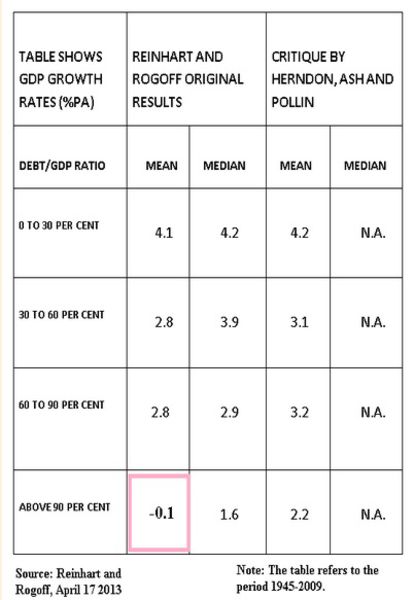

In 2010, two economists with the Harvard University, Carmen Reinhart and Kenneth Rogoff, presented a very deep study of the correlation between government debt and economic growth in a period of 200 years. They found out the following dependence: when the public debt is beyond 90% of the gross domestic product, economic growth is hampered and there are even cases of recession. Their study was quoted massively as its publication coincided with the peak of the debt crisis in the eurozone (note the word "debt"). In 2012, however, a student from the Amherst University in Massachusetts got the task to repeat the analysis of Reinhart and Rogoff. The task proved so difficult that his professors also got involved in the task of young Thomas Herndon.

Herndon and his professors found out that in Reinhart/Rogoff's excel table there was an error, as a result of which the Harvard professors included 15 out of 20 studied countries. From the equation dropped Australia, Austria, Belgium, Canada and Denmark. The mistake was revealed after the official publication of their analysis on April 15th which caused a huge wave of indignation and political hysteria. Professors Reinhart and Rogoff were subjected to sharp attacks and even death threats for that their scientific research had led to mass dismissals of workers and to the destruction of thousands of lives.

4 years earlier

If we go back to the beginning of the debt crisis in the euro area, we will see that it is no accident at all that it was called exactly a debt crisis, although there were a number of attempts to rename it to "confidence crisis", which in fact is one and the same thing. As a result of the global financial and economic crisis, the beginning of which was marked by the default of the gigantic financial company Lehman Brothers, not a few governments resorted to financial injections aimed at protecting the economy from the credit crunch. However, that assistance led to a massive rise of public debts of a number of countries, especially in the euro area which, additionally, suffered not only from unequal, but even not sufficiently converged levels of competitiveness, similar visions about the economic and fiscal policies. Last but not least, there was no tangible coordination of economic and budgetary policies whatsoever.

All the popping up like mushrooms after rain issues in the euro area and the EU at large got flash for the European traditions responses, as a result of which the integration in the EU and especially in the eurozone is significantly deeper than in the beginning of the crisis or before it. An essential element of all the undertaken measures was restricting spending with the aim to reduce budget deficits and debt burdens, which for its part generated panic on the international debt markets. The countries that got assistance from the EU and IMF were practically excluded from the international financial markets because of the unbearable price of the borrowing, due to investors' nervousness.

Interestingly, however, when the data about debt are viewed through the years can be seen that not the countries that piled up debt to save their economies are problematic. The states that entirely fit into the analyses of Reinhart/Rogoff are those that have had high levels of public indebtedness for years. Their economic growth was either too anaemic or was due to other factors. Such is the case of Greece, for instance, for which the Commission data, starting from 1993, show that even then the Greek debt was very high - 98.4% in the period 1993-1997 and 170% of GDP in 2011 when the first haircut was agreed. With large debts has also been Italy for quite a long time. In the period 1993-1997 the  Italian public debt was above 100% of GDP (119%). In 2012, it was already 127 per cent and the expectations this year are that it will exceed 130% of the gross domestic product.

Italian public debt was above 100% of GDP (119%). In 2012, it was already 127 per cent and the expectations this year are that it will exceed 130% of the gross domestic product.

Belgium is also a "sick" country for a long time. Its debt in the period 1993-1997 was almost 130% which drops through the years to below 100 per cent, but this year it is again expected to peak and be 101.4 per cent of GDP. In terms of economic growth in the context of debt, the data are various. For Greece, for instance, the tables of GDP growth show that in the period 1993-1997 the country had an anaemic growth of 1.7%. It accelerates significantly in the next 4-year period to reach 3.8% which could be blamed on the introduction of the single currency, but it should be reminded as well that Greece dressed up its macro economic data to be able to fulfil the criteria for membership in the currency union. With Italy, however, the economic growth moved constantly below 2% until the recession.

The picture in Belgium is also in support of Reinhart/Rogoff's claim because its growth in the period of debt above 100% of GDP was below 2%, while in the period of reduction of debt the growth rises.

Basta

As a matter of fact, the debate has left the academic field long ago and is now in the area of politicising. Politicians and analysts are racing up to say "we told you so" without, however, offering sufficiently convincing arguments and even less a new course. The situation between austerians and spenders escalated in the beginning of the year when IMF's chief economist Olivier Blanchard presented a working paper in which he practically admitted that the too harsh belt tightening was a bar in the wheels of economic growth. Even then the European Commission, in the face of the Finnish Vice president and Economic and Monetary Affairs Commissioner Olli Rehn, said that the policy of fiscal consolidation should continue. His words were supported by an own document of the economic  directorate of the Commission in which it was clearly stated that practically no one ever prevented governments to conduct growth-friendly reforms in parallel to fiscal consolidation.

directorate of the Commission in which it was clearly stated that practically no one ever prevented governments to conduct growth-friendly reforms in parallel to fiscal consolidation.

But the heaviest strike the Commission got exactly from the revelation of the Reinhart/Rogoff mistake. That news caused confusion and as a result Commission President Jose Manuel Barroso was forced to say that the limits of the current policies were about to be reached. That remark of his was taken up by media and quoted many times, but claiming the limit had already been reached. What Mr Barroso actually said on April 22nd was that "the current policies are of course appropriate in terms of reducing the biggest challenge that we have today which is the challenge of unsustainable debt, public and private, the need to deleverage, the need to put Europe on a sound footing so that Europe can be more competitive and can have growth again, but growth that is sustainable, because what we have learned, and this is for me the biggest lesson of the crisis, and I think a lesson that we have not yet all completely drawn, is that growth based on debt is not sustainable".

The difference between what he says and what was heard in media is essential, isn't it? And the first deputy director of the IMF, David Lipton, joined the controversy by saying that countries should have clear and specific commitments for mid-term fiscal consolidation which should be viewed country by country, while consolidation measures should be selected very carefully. Words that can be interpreted as supporting both camps. But this did not prevent Olli Rehn from being literally crucified in the European Parliament economic committee on April 25th when MEPs from all political groups attacked him strongly. According to one of the influential MEPs, Jean-Paul Gauzes (EPP, France), in times of a crisis politicians needed courage and determination, but in the past months these skills cannot be observed in the Commission, he noted.

Olli Rehn reiterated that the high public debt levels in Europe eroded sustainable growth and jobs creation. Elisa Ferreira, a Portuguese MEP from the S&D group, attacked the Commission vice president even stronger saying she came from a country that followed all the recommendations - of the troika, of the Commission, to the letter. The debt of 93% of GDP rose to 124%, unemployment is already 19% and gross domestic product is constantly on the decline. So, enough is enough, she said and added that the situation is going toward a catastrophe. Olli Rehn enraged her recalling that every action has a consequence.

Portugal was on the verge of a disorderly default and that was why the EU and IMF agreed to support the country avoid default. I understand that adjustments are difficult for the citizens, but fiscal consolidation should be oriented toward growth and be socially acceptable, Mr Rehn continued. "There's no need for you to put the earphones on, Commissioner, just memorise this only one word - basta", almost shouted the Portuguese MEP, which was met with an iron face by the EU Commissioner. Philip Lamberts (Greens, Belgium) said the Greens were not simply not friends of debt, but even hated it. They also hate the decisions which "the traditional orthodox thinking promotes", but if they had worked I would have accepted them, the MEP said. Another member of the Parliament objected the too many exceptions from the rules.

In the past, too many member states did not abide with the Stability and Growth Pact rules and continued with their old policies. And today, many exceptions are allowed from the new rules. And what have we achieved in the end, except that we have more regulation and administration, he asked. And another Portuguese member recalled that there should not be only sticks, some carrots were needed as well, especially in the case of Portugal, which already got a carrot - an extension to pay back its EU and IMF loans.

It's not simply about austerity, but structural reforms

On the same day when Olli Rehn was in cross fire by MEPs, professors Reinhart and Rogoff came up with their first official statement after the scandal erupted with the error in their calculations. "We agree that growth is an elusive goal at times of high debt. We know that cutting spending and raising taxes is tough in a slow-growth economy with persistent unemployment. Austerity seldom works without structural reforms — for example, changes in taxes, regulations and labour market policies — and if poorly designed, can disproportionately hit the poor and middle class. Our consistent advice has been to  avoid withdrawing fiscal stimulus too quickly, a position identical to that of most mainstream economists", the professors wrote in a special article for The New York Times.

avoid withdrawing fiscal stimulus too quickly, a position identical to that of most mainstream economists", the professors wrote in a special article for The New York Times.

The austerity brawl led to tensions between France and Germany, too, as Germany is ever more described as the big evil which believes that 100 sticks are not enough on someone else's back and persists that all the 100 sticks should be beaten. All this led to the point where Commission President Jose Manuel Barroso defended the German chancellor, Angela Merkel, and on the Commission blog Olli Rehn wrote that the truth is that fiscal policy in Europe is coloured in different shades of grey. "So it is now better to move beyond the caricatures and close the perception gap. We definitely face major challenges, but it is in the interest of Europeans to stay the course of reform, for the sake of sustainable growth and jobs". Something which was reminded of during the presentation of the spring forecast of the European Commission.

What is at stake now is to make a life saving choice. On the one hand what is offered is a painful operation to remove the tumour publicus debitum after which, however, recovery will follow. May be that recovery will be continuous, may be expensive medicines will be needed, but it is certain that the tumour will be removed forever and metastases will be prevented. Another option is to postpone the operation because the body currently does not want to endure any more pain. And those who believe the operation is too painful and risky recommend painkillers and homoeopathy. But they do not say anything about the metastases and the growth of the tumour to sizes beyond which even an operation would not help.

Klaus Regling | © Council of the EU

Klaus Regling | © Council of the EU Mario Centeno | © Council of the EU

Mario Centeno | © Council of the EU Mario Centeno | © Council of the EU

Mario Centeno | © Council of the EU