Spain and France Get an Extension for the Budget Deficit, but the need of Structural Reforms Remains

Adelina Marini, May 6, 2013

The European Institutions started to retreat under pressure from the anti-austeritists, but in the same time their voices have become stronger in calling that undertaking structural reforms and reducing budget deficits and public debts are not one and the same thing. And if for some Friday was Christmas as they got a present - an extension to correct their excessive budget deficit, all were reminded that this should go hand in hand with structural reforms. The reason on Friday to be Christmas for France and Spain is that the economic difficulties for the two countries are expected to continue and therefore they need more time to put their finances in order.

The European Institutions started to retreat under pressure from the anti-austeritists, but in the same time their voices have become stronger in calling that undertaking structural reforms and reducing budget deficits and public debts are not one and the same thing. And if for some Friday was Christmas as they got a present - an extension to correct their excessive budget deficit, all were reminded that this should go hand in hand with structural reforms. The reason on Friday to be Christmas for France and Spain is that the economic difficulties for the two countries are expected to continue and therefore they need more time to put their finances in order.

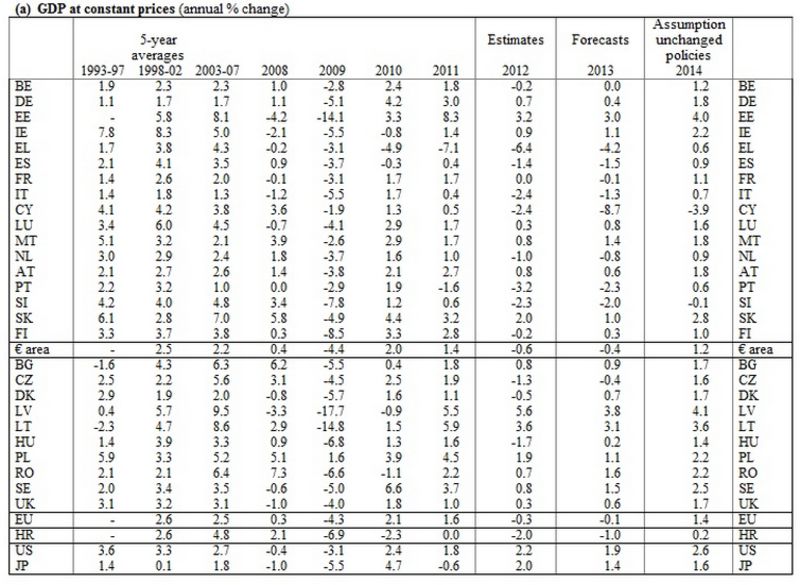

According to the spring forecast of the European Commission, presented by Vice President Olli Rehn, France is expected to make a budget deficit this year of 3.9% and next year - of 4.2 per cent. With Spain, the situation is even harder because the Commission forecast is for deficit in 2013 of 6.5% and in 2014 - of 7 per cent. The need of additional time for recovery can be seen quite clearly from the other indicators. This year, France will have a negative economic growth of -0.1% which is a downward correction from the winter forecast when the Commission expected the French economy to move up by 0.1% growth. Next year, the expectations are for growth of 1.1%, just a slight correction downward from the winter, when 1.2% growth was envisaged in 2014.

Slovenia is also with very high predicted deficits. In 2013, the Commission expects the public finances to have a gap of 5.3% and in 2014 the gap to start narrowing and be 4.9%. Mr Rehn said that for Slovenia, too, an extension could be considered to correct its finances, but that will depend on the reforms package the government of Alenka Bratusek will present in the upcoming weeks. Olli Rehn expects to see the package in the framework of the convergence programme.

In the words of the European Commission vice president, the situation in Slovenia is not as bad as the trends are and it is still manageable. The small Alp country faces significant economic challenges and should immediately address them, as point one on the agenda should be recovery of the financial sector and sustainability of public finances. Judging by the Commission expectations for the rest of the economic indicators, the task Ljubljana faces is very difficult. In 2013, the country will be in recession of -2.0% which will remain next year, too, but will be smaller -0.1%. The situation with unemployment should also be a concern for the Slovene government which took power after months of massive protests mainly against corruption. The Commission forecast is that this year the number of unemployed will reach 10.0 per cent and will remain unchanged in 2014 - 10.3%.

In general, the revision from the winter forecast is not significant. In February, Brussels envisaged unemployment of 9.8 per cent this year and 10.0% next year. With growth, however, the revision is serious. In the winter, Slovenia was expected to come out of recession and move toward economic growth in 2014 by 0.7%. For this year, however, the forecast remains the same as in February.

The outstanding member states in the eurozone

Although in the past months the feeling has returned that the situation in the euro area instead of stabilising is deteriorating again, the picture is not as grim. Out of the 17 member states that share the common European currency, 8 will register economic growth this year. The German economy is expected to expand by 0.4% this year and next year - by 1.8%. Estonia is the most excellent performer in the group whose economy will swell up by 3 per cent this and by 4 per cent next year. The proof that austerity in a combination with structural reforms works is Ireland, which is envisaged to grow by 1.1%  this year and 2.2% next year. Luxembourg is also among the countries with positive growth (0.8 this year and 1.6 next year); Malta (1.4, 1.8); Austria (0.6, 1.8); Slovakia (1.0, 2.8) and Finland (0.3, 1.0).

this year and 2.2% next year. Luxembourg is also among the countries with positive growth (0.8 this year and 1.6 next year); Malta (1.4, 1.8); Austria (0.6, 1.8); Slovakia (1.0, 2.8) and Finland (0.3, 1.0).

The overall outcome for this year in the eurozone is expected to be for recession of -0.4 per cent. In the second half of the year an improvement is expected of the economic situation and for next year the forecast shows growth of 1.2 per cent in the zone of the single currency. The main growth driver will be the international situation, to put it bluntly. As Olli Rehn explained, the good developments globally have a good impact on Europe, too. External demand is expected to increase and this is precisely what will boost economic activity.

The outstanding member states outside of the euro

Outside the euro area, the situation is much more optimistic as out of the 10 non-euro members only one will be in a recession and that is the Czech Republic, whose economy will shrink by 0.4 per cent this year, but next year it is expected to score growth of 1.6%. The most dynamically developing countries in this group are the Baltic non-euro countries - Latvia and Lithuania. The former is expected to expand its economy by 3.8% this year and next year even 4.1%. This is the only country in this group which aspires for eurozone membership, expected on January 1st 2014. Lithuania will also have very strong growth rate of 3.1 per cent this year and 3.6 in 2014. With both countries there is no significant change compared to the winter forecast which can be interpreted as sustainability of the two countries' efforts.

In the winter, Hungary was the second country which was expected to be in a recession this year of -0.3% and next year to have an anaemic growth of 1.3%, but the Commission has revised its forecast upward and expects in 2013 the Hungarian economy to move up by 0.2% and in 2014 to expand by 1.4%. With Bulgaria, however, the situation is corrected downward. In February, there was an expectation of a 1.4% growth this year and 2.0% next year, while in May the expectations are for 0.9% growth this and 1.7% next year. For the entire EU, the expectations are for negative growth of -0.1% in 2013 and positive of 1.4% next year.

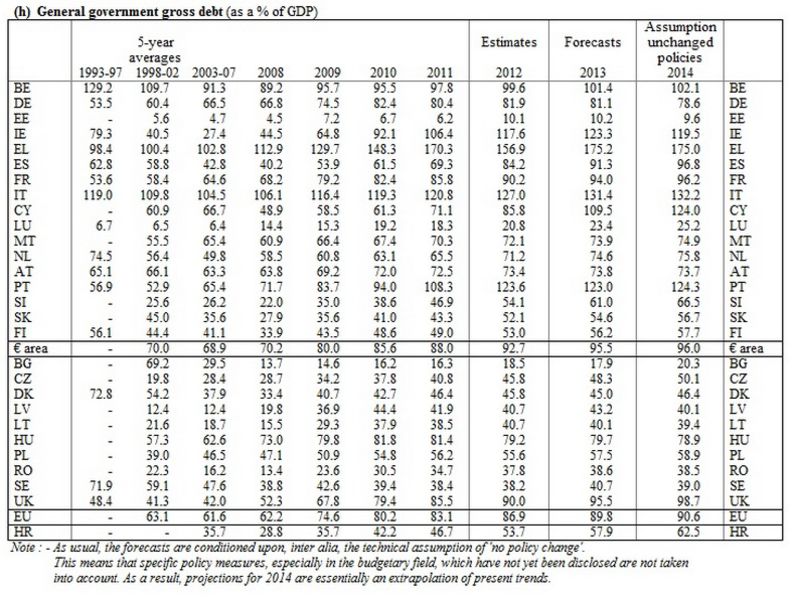

Debts continue to grow

And although in many member states there are adjustments going on of macro economic imbalances, in some high indebtedness is expected to hamper economic growth. The debt burden is very high in most of the EU member states. The highest it is in Greece. This year, the Greek public debt is expected to be 175.2% of GDP and next year the forecast is for a slight drop to 175.0. Second in terms of indebtedness in the eurozone is Italy, which is a long-term champion. In 2013, its public debt will take up 131.4% of GDP and next year the Commission expects a drop to 132.0. The Italian public debt has been above 100% since 1993. With levels above 100% of GDP are also:

Belgium - 101.4% in 2013 and 102.1% in 2014;

Ireland - 123.3% in 2013 and 110.5% in 2014;

Cyprus - 109.5 this and 124.0% next year.

In France, the level of debt is expected also to rise from 94.0% to 96.2% and in Spain - from 91.3% to 96.8%. In Slovenia, too, a rise is expected of government indebtedness from 61.0% to 66.5%. With the lowest debt level in the eurozone is Luxembourg - 23.4% of gross domestic product, but the forecast shows an increase in 2014 to 25.2%. The general indebtedness in the euro area this year will be 95.5% and next year - 96.0%. In the non-euro countries the rosiest situation is in Estonia, which has the lowest public debt level of all the 27 EU member states. This year, its debt is expected to be 10.2% and next year to drop to 9.6%, the Commission estimates. The next country with second lowest debt level is Bulgaria* with 17.9% expected this year, but next year the Commission forecasts an increase to 20.3% of GDP. With the highest level of debt in the non-euro countries will be Hungary - 79.7% of GDP in 2013, but next year it is expected the debt to start declining and to be 78.9%.

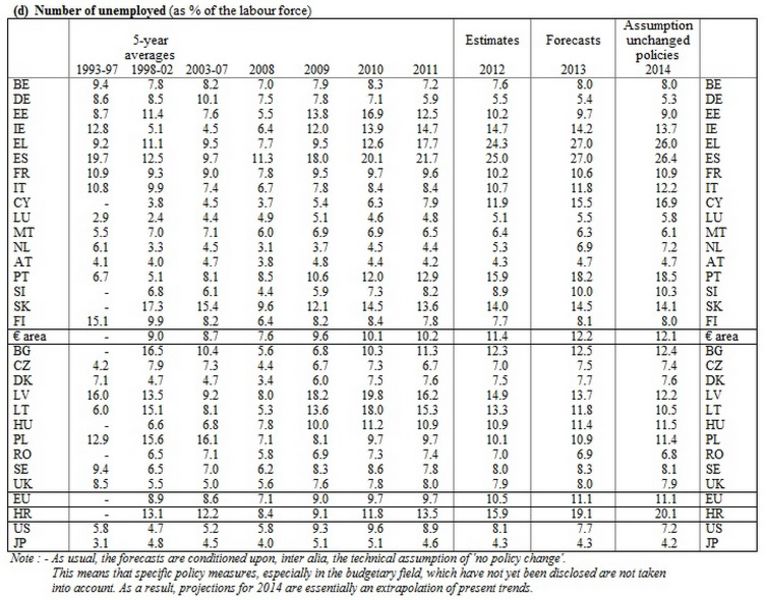

The big enemy - unemployment

The biggest problem still is unemployment which in some countries is record high. In 2013, Spain and Greece will share the first place with expectations of 27.0% share of unemployed. The situation is not at all encouraging in many other member states. With rates above 10 per cent will be: Ireland, France, Italy, Cyprus, Portugal, Slovenia, Slovakia, Bulgaria, Latvia, Lithuania, Hungary, Poland. This year, the countries with the lowest unemployment rate are expected to be Austria (4.7%), Germany (5.4%) and Luxembourg (5.5%).

The biggest problem still is unemployment which in some countries is record high. In 2013, Spain and Greece will share the first place with expectations of 27.0% share of unemployed. The situation is not at all encouraging in many other member states. With rates above 10 per cent will be: Ireland, France, Italy, Cyprus, Portugal, Slovenia, Slovakia, Bulgaria, Latvia, Lithuania, Hungary, Poland. This year, the countries with the lowest unemployment rate are expected to be Austria (4.7%), Germany (5.4%) and Luxembourg (5.5%).

What is it that you did not understand about structural reforms?

Both the European Commission and the European Central Bank were unanimous that what the member states need to continue to do is structural reforms. Even as a sign of good will and hoping this would support the European economy, ECB Governing Council decided on May 2nd to reduce the interest rate of the main refinancing operations by 25 basis points to 0.50%. According to ECB, there is justification for such a decision because of the continuous low price pressure in the mid-term. However, this does not mean that structural reforms should cease, Draghi underscored. "In the meantime, it is essential for governments to intensify the implementation of structural reforms at national level, building on progress made in fiscal consolidation and proceeding with bank recapitalisation where needed", the European central banker explained.

Asked but a journalist whether he is one of the few still standing proponents of austerity (an austeritist), Mario Draghi said progress should not be unravelled. "And there is no doubt that significant progress has been made in terms of fiscal consolidation throughout the entire euro area". Mario Draghi did not give concrete examples, but they can be seen quite clearly in the data in Olli Rehn's spring forecast. The Irish economy has started to grow and its debt is expected to gradually decline. The budgetary deficit is also expected to sharply drop from 7.5% this year to 4.3% in 2014. Even the problematic Greece is expected to expand its economy next year by 0.6%, while its debt is expected to even start declining, although insignificantly.

Really good examples, though outside the eurozone, are also Lithuania and Latvia, which went through a very tough recession, but they already have enviable growth and declining indebtedness. Estonia, which is in the eurozone since recently, is also in a process of reducing its public debt.

Mario Draghi also recalled that the big problem with fiscal consolidation stems from the fact that some countries preferred to raise taxes rather than painful reductions of spending. "And here we are talking about raising taxes in an area of the world where taxes are already very high, so it is no wonder that this had a contractionary effect. However, now that there is more time, there could be a shift towards reducing current government expenditure and lowering taxes", the central banker explained a day before Olli Rehn officially announced the extension for France and Spain. He obviously had in mind  France where the socialist president, Francois Hollande, undertook a sharp rise of taxes to avoid his odious budget constraints.

France where the socialist president, Francois Hollande, undertook a sharp rise of taxes to avoid his odious budget constraints.

Last but not least, Draghi pointed out still in response to the question about the last standing austeritist, a key factor is the recovery of confidence which has become possible thanks to the fiscal consolidation. And again structural reforms: "Many of the problems that we see today in terms of competitiveness, the labour market and taxes have nothing to do with monetary policy. They cannot be fixed by monetary policy. They can only be fixed by changing what is wrong in these three areas". And although he said the ECB was ready to help with everything it could, Draghi underlined that ECB could replace the lack of structural reforms in governments nor could it clear banks' balance sheets.

Olli Rehn was also asked a question related to austeritism, to which he responded in the usual way pointing out that he was following the academic debate, but the Commission based its policies not on only one study, but on many. Historic data are also used, as well as analyses of own experts. He also stressed on structural reforms as inevitable and going in parallel with the efforts for budget consolidation.

*In a previous version of this article it was incorrectly stated that the EU country with the lowest debt level is Bulgaria, while it is Estonia

Klaus Regling | © Council of the EU

Klaus Regling | © Council of the EU Mario Centeno | © Council of the EU

Mario Centeno | © Council of the EU Mario Centeno | © Council of the EU

Mario Centeno | © Council of the EU