Asymmetry of Competitiveness

Adelina Marini, June 5, 2013

If it was not for the crisis, hardly there would have been a battle with the tax havens and the impediments to the completion of the EU single market of energy. A remark of the sorts uttered European Council President Herman Van Rompuy after the end of a really odd and short EU summit on May 22nd. In fact, the purpose of the summit was not as ambitious as it seemed at first glance. According to Mr Van Rompuy, the purpose was to "defrost" many topics which the eurocrisis stole the attention from and European Commission President Jose Manuel Barroso said that the status quo was no longer an option and that commitments should finally be implemented. The council, though short, took out for "melting" two major issues - the fight with tax fraud and tax havens, and the completion of the common energy market.

If it was not for the crisis, hardly there would have been a battle with the tax havens and the impediments to the completion of the EU single market of energy. A remark of the sorts uttered European Council President Herman Van Rompuy after the end of a really odd and short EU summit on May 22nd. In fact, the purpose of the summit was not as ambitious as it seemed at first glance. According to Mr Van Rompuy, the purpose was to "defrost" many topics which the eurocrisis stole the attention from and European Commission President Jose Manuel Barroso said that the status quo was no longer an option and that commitments should finally be implemented. The council, though short, took out for "melting" two major issues - the fight with tax fraud and tax havens, and the completion of the common energy market.

The energy revolution the EU is about to miss

The energy issue dominated the several hours long summit, as in the words of Irish Premier Enda Kenny (on behalf of the rotating Council presidency) the debate on it took two thirds of the time. Herman Van Rompuy explained that this was the most right moment for strategic debate. "For a simple reason. The world is in the midst of an energy revolution, doubled with a race for resources. Soon Europe could be the only continent to still depend on imported energy. Households feel the weight of high prices. Industry finds it hard to compete with foreign firms who pay half the price for electricity, like in the United States".

The progress of the transatlantic partner as well as its significant competitive advantages were at the centre of discussions of many of the EU leaders, although the summit can symbolically be divided into three groups: proponents of shale gas, tax-enthusiastic leaders and introvert leaders who were mainly interested in youth unemployment rather than in long-term obstacles to the development of the European economy (ergo of national economy too).

As a main spokesman of the first group emerged UK's Prime Minister David Cameron, who started his national briefing on the May 22 afternoon in Brussels with the words that Europe had some 75% or three fourths of the shale gas the US had. Nonetheless, the Americans are currently drilling 10 000 wells annually, while in Europe less than 100 are being developed. "So, it is no surprise that for the past decade the Americans have increased the extraction of shale gas from 1 to 30%. And here the Europeans are paying double on what the Americans pay for gas. This is a huge gap in terms of competitiveness", Cameron explained. He did not say directly that Europe should move toward to a more accelerated regime of gas extraction from shale, but said that it should be done so that all rules aimed at different technologies "will not pull us back".

And although the new prime minister of Italy, Enrico Letta, focused entirely on domestic Italian-European issues, he touched briefly the energy issue saying that the US's progress in the area of shale gas creates "asymmetry of competitiveness between US and Europe which worried everyone". But he only added that the discussion was continuous and that US currently had a very strong competitive advantage. The Irish prime minister, in his turn, refrained from taking sides, sticking only to informing the Irish journalists what exactly was discussed. As euinside predicted, fracking was the main issue  during the talks. In this context, the Commission made a presentation showing that industrial gas prices increased by 35% in EU, while in US they dropped by 66 per cent, "which has huge consequences for competitiveness", as Kenny put it.

during the talks. In this context, the Commission made a presentation showing that industrial gas prices increased by 35% in EU, while in US they dropped by 66 per cent, "which has huge consequences for competitiveness", as Kenny put it.

He quoted Poland's Prime Minister Donald Tusk, according to whom if Poland decided to deal with fracking the costs will be around 15 billion euros even before extraction had begun. The Irish premier recalled, though, that the energy sector created jobs. And he again quoted the United States where for the past 12 months a million jobs have been opened only in the energy sector. And although the shale gas dominated the agenda of the summit, the conclusions and the statements of the chiefs of the Commission and the European Council made it clear that the division on the issue was even more dominating. According to Mr Van Rompuy, it is necessary the energy and climate policies to become more predictable.

"Yes, this includes shale gas, which could become part of the energy mix for some member states, perhaps less for others. It's of course up to each country to decide its own energy mix. More generally, leaders agreed on the need to better coordinate, especially, and in advance, on major national energy decisions with an impact on other countries", said the European Council chief [bolding is done by euinside]. And the conclusions read that the Commission will make an assessment on "a more systematic recourse to on-shore and off-shore indigenous sources of energy with a view to their safe, sustainable and cost-effective exploitation while respecting Member States' choices of energy mix".

Judging from the outcome of the summit, it can be said that shale gas is another element that deepens the division between the member states. Although they say in their conclusions that it is vital to enhance further the diversification of energy supplies for Europe and to develop inherent energy resources, the leaders nonetheless insist on the national approach. They agree that they will enhance their cooperation in such a way to reflect the more close interconnectedness of the internal and external energy markets, but nothing more specific than that is pointed. Also agreed is to "follow up on its conclusions of November 2011 and review developments regarding EU external energy policy, including the need to ensure a level playing-field vis-à-vis third country energy producers as well as nuclear safety in the EU neighbourhood following up on the European Council conclusions of June 2012". This means  nothing but an indeed a warm up of the agreements from February 2011 when, again, the ambition was not great, but even more so nothing has been achieved so far.

nothing but an indeed a warm up of the agreements from February 2011 when, again, the ambition was not great, but even more so nothing has been achieved so far.

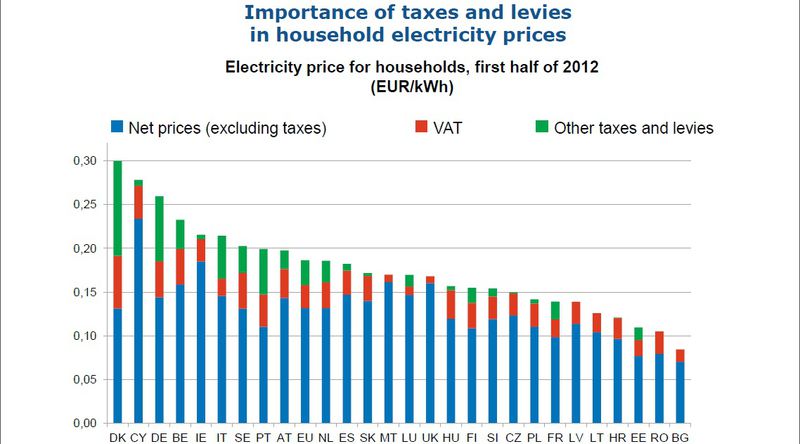

The only concrete results are expected from the Commission which, except the shale gas report, will also present by the end of the year an analysis of the factors that determine the energy prices and energy costs in the member states with a special focus on the burden for households. But today's data, which the Commission distributed several weeks before the Council, are quite telling, too. They reveal that the poorest EU member state which is also the most dependent on a single energy supplier consumes the most expensive natural gas in EU.

For one hidden dollar

Almost as productive are the results from the taxation part of the summit. The leaders agreed to expand the scope of the automatic information exchange at EU and global level. But in general, the battle will be led on global level first - within the G8 which this year is presided by UK. It is worth mentioning that the tax issue was more interesting for the journalists in Brussels than the energy topic, in spite of the reverse proportionality of the discussions. The tax issue also marked a division among the 27. In the conclusions from May 22, it is written that at international level EU will play "a key role in promoting the automatic exchange of information as the new international standard, taking account of existing EU arrangements. The European Council welcomes ongoing efforts made in the G8, G20 and OECD to develop a global standard".

This refers to a decision that has been approved by the ministers of finance a little before the summit, according to which five member states (France, Germany, Italy, Spain and UK) will establish a new global standard according to a model agreed with the US. On this issue, David Cameron said that this summer he had the ambition to "break up the walls of corporate secrets and today we agreed to fight for a new international standard for automatic exchange between the tax authorities and to help those authorities to fight tax evasion with information who in fact owns and controls each and every company". But in general, on this topic, too, the national measures will prevail which is not a good news for Jose Manuel Barroso's efforts who had really great ambitions for this council.

Unemployment above all

The prime minister of Italy emphasised during his meeting with Italian media in Brussels after the tax-energy council, that he was most satisfied with the fact that his idea about tackling youth unemployment would be included in the agenda of the June European Council (28-29 June). A confirmation of this commitment made President Herman Van Rompuy who a week later met with Letta in Rome and said that he had agreed with him youth unemployment to be moved very high on the  agenda. Currently in Europe, there are more than seven million young people who are neither involved in the education system, nor do they have a job, said Mr Van Rompuy. But he cooled the Italian flame down by saying that social and employment policies are predominantly a national responsibility.

agenda. Currently in Europe, there are more than seven million young people who are neither involved in the education system, nor do they have a job, said Mr Van Rompuy. But he cooled the Italian flame down by saying that social and employment policies are predominantly a national responsibility.

Nevertheless, Herman Van Rompuy will try to pass five of the ideas discussed with Enrico Letta at the EU summit in a few weeks. The first is to accelerate the new initiative for fighting youth unemployment through ensuring the co-financing for the regional projects from January 1st 2014; accelerating the creation of the youth unemployment schemes in all the member states; directing all the available resources, like for instance from the EIB and the European Globalisation Fund, toward the fight with youth unemployment; involving the social partners and the employers' organisation in the search of more practical solutions and in the exchange of good practises; increasing labour mobility in the EU. The latter will surely not be to the liking of British Prime Minister David Cameron. And not only to his.

It is clear as early as now that there are too much hopes for the leaders to take pressing solutions on many European problems, but it is evident that the focus again will be on the banking union and its future. This is also something the EU is under strong pressure from the outside through the International Monetary Fund. According to a recently completed mission of the Fund in Germany, the preliminary results of which were published on June 3rd, German economy's growth is expected to slow down this year. Due to the uncertainty in the rest of the eurozone, the gross domestic product is expected to grow  by only 0.3%. The Fund recommends Germany not to over perform fiscal consolidation which is a direct hit in the war between austerians and spenders.

by only 0.3%. The Fund recommends Germany not to over perform fiscal consolidation which is a direct hit in the war between austerians and spenders.

And regarding Spain, the conclusion of the Fund is that in order to avoid the risks it is necessary actions at eurozone level to be undertaken. Such actions could be "timely implementation of banking union and ensuring maintenance of a sufficiently accommodative monetary stance". All this suggests that another very tense June summit is coming up after which no one will even remember the tax-energy issues. They will again be "unfrozen" in February when a special European Council will take place, dedicated on competitiveness and industrial policy. Of course, it is not impossible those issues to emerge high on the agenda in Europe if supplies for a member state are hindered or if another tax haven is on the verge of bankruptcy.

Ildikó Gáll-Pelcz | © European Parliament

Ildikó Gáll-Pelcz | © European Parliament | © European Commission

| © European Commission Dalia Grybauskaite | © MSC/Koerner

Dalia Grybauskaite | © MSC/Koerner Maros Sefcovic, Miguel Arias Canete | © European Commission

Maros Sefcovic, Miguel Arias Canete | © European Commission Jean-Claude Juncker, Boyko Borissov | © European Commission

Jean-Claude Juncker, Boyko Borissov | © European Commission