Is the European Pensioner Coming?

Ralitsa Kovacheva, February 20, 2012

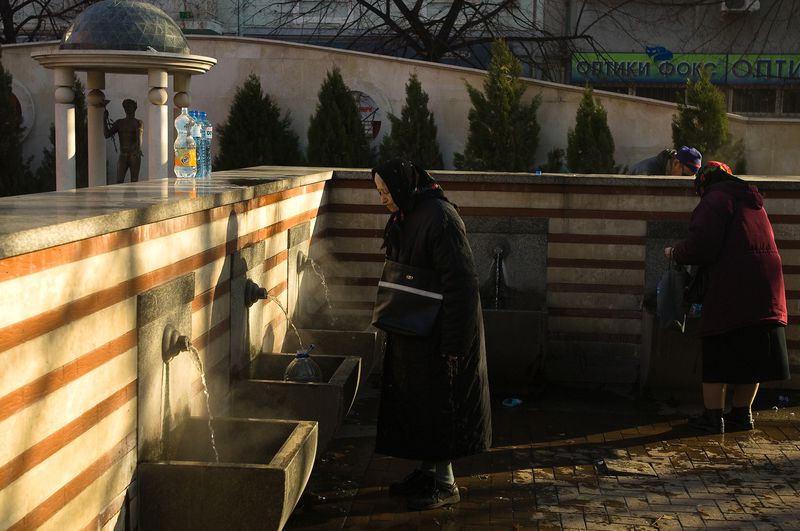

The number of pensioners in Europe will increase, but their pensions will be smaller. The number of workers will decrease and they will work more and longer. By 2060 there will only be two adults of working age for every pensioner. Currently the ratio is 4:1.

The number of pensioners in Europe will increase, but their pensions will be smaller. The number of workers will decrease and they will work more and longer. By 2060 there will only be two adults of working age for every pensioner. Currently the ratio is 4:1.

This gloomy outlook is outlined in the Green Paper on pensions, published by the European Commission in July 2010. The document was intended to initiate a Europe-wide debate on the subject because, while many of the problems have existed for years, solving the current crisis has made them indispensable as a matter of urgency. Because the cost of pensions will exert increasingly serious pressures on the troubled national budgets amidst the high deficits and debts. In the EU as a whole pension costs are more than 10% of GDP on average and are expected to exceed 12 percent by 2060. The situation in individual countries is very different - while Ireland pays for pensions only 6% of its GDP, Italy pays 15%.

On the one hand, life expectancy in Europe keeps growing, which means that  people receive pensions for a longer time. Adding the generous early retirement options, this period is becoming even longer. On the other hand, the working population is decreasing and has been hit hardly by unemployment as a result of the crisis – so fewer people pay pensions contributions and more people will not be able to receive better pensions because of the years of unemployment. As a result, the pay-as-you-go pension schemes (state-sponsored pension systems) are under financed and the funded schemes (based on individual contributions into a personal account) are affected by falling asset values and reduced returns.

people receive pensions for a longer time. Adding the generous early retirement options, this period is becoming even longer. On the other hand, the working population is decreasing and has been hit hardly by unemployment as a result of the crisis – so fewer people pay pensions contributions and more people will not be able to receive better pensions because of the years of unemployment. As a result, the pay-as-you-go pension schemes (state-sponsored pension systems) are under financed and the funded schemes (based on individual contributions into a personal account) are affected by falling asset values and reduced returns.

All these problems must be solved simultaneously and more importantly - immediately. In some countries this is already happening, though under the dictate of unavoidable circumstances, for example in Greece. Others have tried to mask the situation, like Hungary, simply forcing its citizens to transfer their private retirement accounts into the state fund and thus "filling" its budget deficit – no one believed the country, but as the Commission notes, it "revealed the importance of the treatment of systemic pension reforms in the Stability and Growth Pact."

The point is that pension systems are a sole responsibility of the member states, so any initiatives at European level are met with scepticism and suspicion. This is completely obvious from the White Paper on pensions, published on 16 February 2012, in which the Commission summarises the results of the consultations. The Commission has received nearly 1700 responses from the member states` governments, national parliaments, business organisations, trade unions, civil society, pension funds.

Most member states have clearly stated that they would prefer deepening rather than expanding the existing European framework for pensions. In other words - the decisions on pension systems to remain national. Also, although there was broad support for removing obstacles to mobility caused by pension rules, there was "less agreement on what this should mean in practical action", given the countries do not want any change in current rules on coordination of social security systems. National governments are more willing to give wider powers to the EU in terms of supplementary pension schemes.

This resistance is understandable, given the sensitivity of the "budget sovereignty" issue. But, as the Commission notes, "the success or failure of national pension policies and reforms has ever stronger repercussions beyond national borders, particularly in the Economic and Monetary Union (EMU)." This naturally makes pensions "a matter of common concern in the EU." The first steps in this direction are already a fact - in the Europe 2020 strategy and the strengthening of economic governance at European level. And perhaps the most significant change can be found in another important and topical document - the Treaty of Stability, Coordination and Governance in the EMU, known as the fiscal pact. It is an intergovernmental treaty, supported by 25 EU member states, which is to be signed in early March.

The treaty states a number of times that greater coordination of economic policies would be pursued on issues that are essential for the smooth functioning of the Economic and Monetary Union (EMU), although the areas are not specifically named. In the White Paper on pensions, however, we find the following sentence: "Indeed, the success of retirement reforms in the Member States is a major determining factor for the smooth functioning of the Economic and Monetary Union" And since the probability the completely identical wording to be a coincidence is equal to zero, the conclusion is that, though hardily, national governments are beginning to understand the need for a common solution to the problems in the pension systems. Such a change is not surprising, given the severe shocks experienced by Europe in the past year and a half. And once the phrase "fiscal union" has been said, nothing is the same.

Of course, a common solution does not mean that “one size fits all”, as is clear from the White Paper. The overall objective, set by the European Commission, is to ensure financial sustainability of pension systems, along with adequate pensions, because it is not enough just to have ‘some’ pensions, given the decreasing replacement rate (pensions relative to previous earnings). The only way to change this is people to work longer, while making complementary retirement savings.

However, until recently we have had the opposite trend, although according to the European Commission it has started to reverse - the employment rate of 55-64 aged people is below 50% in the EU as a whole. Of course, the data vary widely between different countries - only one third of people aged 55-64 are employed in Malta, and over 70% in Sweden. If you look at the map on the left, you will clearly see that people work longer in countries with successful economies. The countries currently having economic problems are those with an employment rate of old workers below the EU average.

However, until recently we have had the opposite trend, although according to the European Commission it has started to reverse - the employment rate of 55-64 aged people is below 50% in the EU as a whole. Of course, the data vary widely between different countries - only one third of people aged 55-64 are employed in Malta, and over 70% in Sweden. If you look at the map on the left, you will clearly see that people work longer in countries with successful economies. The countries currently having economic problems are those with an employment rate of old workers below the EU average.

In its Annual Growth Survey 2012, the European Commission recommended reforms carried out at national level to be aimed at linking the retirement age with increases in life expectancy, restricting access to early retirement schemes, supporting longer working lives and life-long learning, equalising the retirement age between men and women and supporting the development of complementary retirement savings.

"Moreover, the political acceptance of such reforms will depend on whether they are perceived as fair," the Commission notes, while stressing that the physical ability to work and to find employment vary widely in different member states. In this sense, the health condition is an important factor, moreover, that the healthcare costs are also an essential part of national budgets.

And although the White Paper leaves the reader with a sense of disappointment, given the lack of concrete measures, actually the white swallow of change is a fact. Once Member States have agreed that national budgets are not only their own business and can be discussed at (and much more – corrected by) Brussels, they are apparently aware that soon this will also apply to tax, pension, social and health care systems. The question now is not whether but when. And given the scale of the crisis and the looming of difficult economic years, the answer is only one: soon.

| © European Union

| © European Union | © euinside

| © euinside | © The Council of the European Union

| © The Council of the European Union | © SofiaUtre/Bonchuk Andonov

| © SofiaUtre/Bonchuk Andonov | © EU

| © EU | © EU

| © EU