Bulgaria Cannot Participate in the 1st Pillar of the Banking Union Without Being Part of the Second

Adelina Marini, January 7, 2015

On 1 January 2015 has started functioning, although not at full steam, the second pillar of the banking union - the single resolution mechanism for failing banks. In November 2014, the European Central Bank (ECB) has assumed its new supervisory functions and as of the beginning of this year the single resolution board has started working after the Council and the European Parliament approved in December the appointments of its chairperson and the other five permanent members. As head of the board has been appointed Elke König who, before that, was head of the German federal financial supervision body. Ms König was selected after a competition and was heard by the European Parliament's economic committee. The same happened with the other permanent members of the board - vice chair Timo Löyttyniemi, the director of strategy and policy coordination Mauro Grande and the directors for planning and resolution Antonio Carrascosa, Joanne Kellermann and Dominique Laboureix.

On 1 January 2015 has started functioning, although not at full steam, the second pillar of the banking union - the single resolution mechanism for failing banks. In November 2014, the European Central Bank (ECB) has assumed its new supervisory functions and as of the beginning of this year the single resolution board has started working after the Council and the European Parliament approved in December the appointments of its chairperson and the other five permanent members. As head of the board has been appointed Elke König who, before that, was head of the German federal financial supervision body. Ms König was selected after a competition and was heard by the European Parliament's economic committee. The same happened with the other permanent members of the board - vice chair Timo Löyttyniemi, the director of strategy and policy coordination Mauro Grande and the directors for planning and resolution Antonio Carrascosa, Joanne Kellermann and Dominique Laboureix.

The term of the chairperson is three years and of the others is five years. This is the institution that will deal mainly with the resolution of failing banks. The role of the board is to prepare plans for restructuring which is a very complicated and huge effort. Usually, such plans have a volume of more than 1000 pages. It is possible the board to only help with an already developed plan by the national resolution authorities. The board is a completely autonomous institution which works with its own budget formed by contributions from banks. Its budget in 2015 is 22 million euros. It is envisaged the number of the staff to be around 250 as the legal documents set a ceiling of 309 people most of whom will work on resolution plans, on decisions of national authorities and with the ECB.

As euinside wrote in detail last year, as a supervisor the ECB will send a notification to the board that a bank is failing. The board will then adopt a resolution scheme. The proposed scheme will enter into force within 24 hours after its approval but the finance minsters of the EU can reject the decision via a simple majority upon a proposal by the European Commission. A very complicated system which is yet to be tested in practise. Currently, the board does not work on any resolution cases but it is not impossible to join ongoing processes. The team is mainly engaged in appointment procedures. The board will work in the next few months together with a special taskforce until it fully assumes its functions. The board's headquarters is in Brussels.

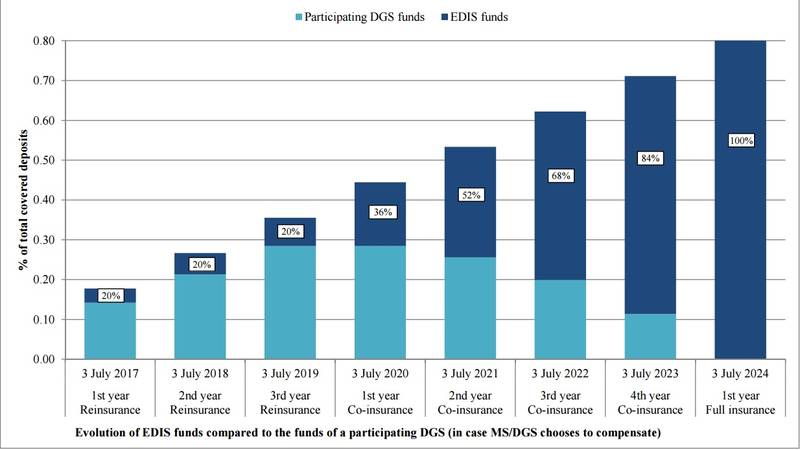

A major element of the second pillar of the banking union is the single resolution fund (SRF). On 19 December last year the Council has approved also the regulation that defines the national contributions to the fund which will come entirely from the private sector, which means the financial institutions. The recently adopted recovery and resolution directive (BRRD) envisages the participant countries in the banking union to start establishing their own funds from January 1st and in 8 years their funds will gradually merge in the common fund. Until that happens, the contributions will be defined on national level on the basis of covered deposits. In SRF, however, the contributions will be calculated on the basis of the sum of the covered deposits in all institutions in the participant countries. The banks will make annual contributions to the fund, calculated on the basis of their liabilities, excluding their own funds and the covered deposits. The risk will also be taken into account and as it varies from a bank to bank a flat rate will be applied which will vary from 0.8 to 1.5.

The overall goal is in 2023 the single resolution fund to be full with at least 1% of the covered deposits. According to estimates by the European Commission, this will be around 55 billion euros. The participant countries will begin collecting money in their national compartments this year because the goal is the fund to start working as of January 2016. By then the state-aid rules will apply.

Bulgaria's unique case

Around the crisis with Corporate Commercial Bank, Bulgaria has announced a major priority to join only the first pillar of the banking union - the single supervisory mechanism (SSM). The banking union consists, practically, of two pillars - the supervisory mechanism and the single resolution mechanism. There is a third element, as well, but it is not as fundamental as the first two - the deposit guarantee scheme. The priority for accession to the SSM was articulated last year by President Rossen Plevneliev and has been included in the coalition programme of Boyko Borissov's second government. There, priority number 13 is: "A political decision Bulgaria to join the European banking supervision".

According to sources from the banking union euinside spoke to, however, it is not possible a country to be a member only of the supervisory mechanism. If a country decides to join the supervisory mechanism it automatically triggers the resolution mechanism as well. This means that if the Bulgarian government really plans to send a request for joining the banking union, it should be aware that it needs to prepare for the establishment of a national resolution fund the contributions to which will gradually be transferred to the common fund. At the moment, in Bulgaria is in force an insolvency of banks act in which a key role plays the deposit guarantee fund. However, this is far from what has been agreed in the banking union. It is obvious that the ruling parties in Bulgaria are trying to transfer the problem with CCB from the sick head to the healthy one, but as euinside wrote, the problem is not a banking one in nature and can only be resolved through introducing rule of law.

Elke Koenig | © European Commission

Elke Koenig | © European Commission | © European Commission

| © European Commission | © European Commission

| © European Commission