ESM To Transform into a European Monetary Fund

Adelina Marini, October 12, 2017

This year is on its way to repeat the ambition of 2012 when the construction of the banking union started and when the permanent rescue fund of the euro area was created. That was the year when a big step in the euro area integration was made and in the EU at large. After a five-year deadlock in the EU, there is again an impetus to complete what was started, as the culmination is expected in December when the European Commission will present a comprehensive legislative package for euro area reform, but until then there will be intensive discussions in the Eurogroup on the issues the Commission proposed for reflection in the end of May. The discussions started in September, but the direction was set back in June when the International Monetary Fund chief, Christine Lagarde, presented the annual analysis of the eurozone.

This year is on its way to repeat the ambition of 2012 when the construction of the banking union started and when the permanent rescue fund of the euro area was created. That was the year when a big step in the euro area integration was made and in the EU at large. After a five-year deadlock in the EU, there is again an impetus to complete what was started, as the culmination is expected in December when the European Commission will present a comprehensive legislative package for euro area reform, but until then there will be intensive discussions in the Eurogroup on the issues the Commission proposed for reflection in the end of May. The discussions started in September, but the direction was set back in June when the International Monetary Fund chief, Christine Lagarde, presented the annual analysis of the eurozone.

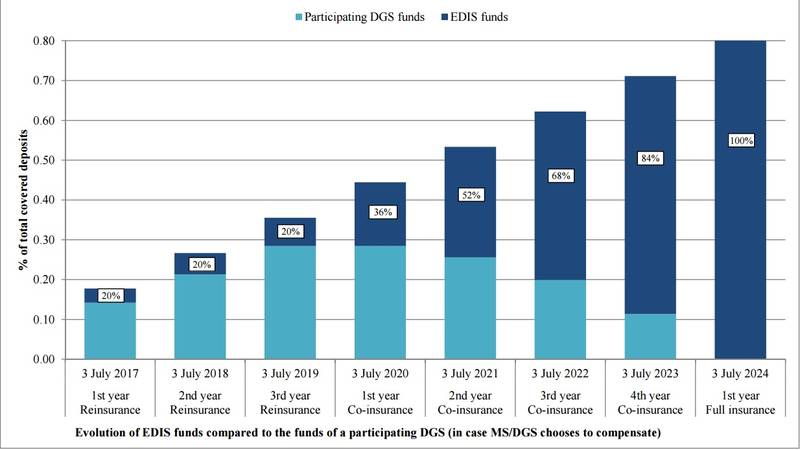

She pointed out then that the economic recovery of the currency block is now largely broad-based, led by domestic demand, therefore IMF would correct upward its outlook for the euro area, which it did in the beginning of this week (by 0.3%). According to the latest forecast, the euro area economy will expand by 1.9% in 2018. The improved economic perspectives of the currency club are a good opportunity to strengthen its architecture, said Mrs Lagarde in June. To her, the most important elements are the creation of a capital markets union, which in the case of a Brexit could lead to transfer of some of the activities that are currently in London. In addition, she believes that Europe needs a common fiscal capacity (a form of a common budget) and to complete the banking union by building the third pillar - the European Deposit Insurance Scheme (EDIS).

But to complete the banking union it is necessary to clear moral hazard. This, in Mrs Lagarde's words, can happen by solving the issue with non-performing loans (work is under way) and by increasing supervision. On some of these issues work is either frozen or is slow, especially when it comes to EDIS. On this occasion, the Commission proposed on October 11 a gradual introduction of EDIS and urged a consensus be found (on this issue expect more details in a separate article on euinside).

The euro area no longer needs the IMF

While awaiting the restart of work on the banking union, the euro area finance ministers are on their way to reach an agreement on expanding the powers of the European Stability Mechanism (ESM). At their meeting on Monday afternoon, the ministers united around the idea the ESM to start playing a major role not only in the management but also in prevention of crises. The ESM was established as a permanent bailout fund for the euro area to finance adjustment programmes of countries, which during the debt and financial crisis were on the brink of a default. The ESM was built over the temporary rescue fund (EFSF), created to finance Greece's bailout programme.

The Mechanism has 80 bn euros of capital. It is getting the money for adjustment programmes by selling sovereign bonds and bills on the international markets, benefiting from its excellent credit rating. The creation of the fund practically put an end to the domino effect started by Greece. The ESM ceiling is 700 bn euros. After its creation, the ESM turned into one of the most important members of the so called Troika, which is monitoring the implementation of rescue programmes. The ESM pays the agreed tranches only after a complete review of the implementation of each stage of a programme.

Everyone in the Eurogroup agrees that ESM's work has so far been successful and that is why they are willing to work on expanding it. There are no concrete conclusions yet but Eurogroup President Jeroen Dijsselbloem (The Netherlands, S&D) said that there was a broad support among the ministers the ESM to participate in ensuring a backstop for the second pillar of the banking union - the Single Resolution Fund (SRF) - which is a significant change of moods compared to before when there were serious reservations to that idea. The ESM upgrade, however, requires work on many other elements of  the banking union and the overall vision for the future of the euro area. That is why the ministers will hold a much deeper discussion on many issues in November.

the banking union and the overall vision for the future of the euro area. That is why the ministers will hold a much deeper discussion on many issues in November.

ESM chief Klaus Regling believes the ESM can absorb the functions of the IMF. "In my view, and that's what I told ministers today, in the future, in case there's a new programme needed, which I don't expect any time soon, I believe that the ESM and the EC should work together. That would mean a broader ESM engagement and programme design and monitoring". He added that the ESM is monitoring the big economies in the euro area already now but it is necessary that it is expanded. Klaus Regling assured that this will not lead to overlapping with the monitoring the Commission does under the European Semester.

The idea the ESM to transform into a European Monetary Fund is part of the reflection paper of the Commission on the future of the eurozone, where it is presented as a central instrument to manage potential crises in the economic and monetary union. Its participation in the SRF is another idea in the document. Its implementation, however, will be a very complex legal exercise because both the SRF and the ESM are created outside the EU's legal framework - they are intergovernmental agreements, which is not to the liking of the Commission or the European Parliament. ESM has been created as an intergovernmental treaty because, at the time, this was the only possibility to avoid the opening of the EU founding treaties for amendments, which would have unleashed a wave of referenda at a time when populism was on the rise and there was no time to lose. Similar is the case with the SRF.

This is also the reason behind the deadlock in the banking union. Klaus Regling proposed to keep the intergovernmental approach to allow a launch of the deepening of the integration in the eurozone, and when there are favourable conditions, to work for the incorporation of these agreements into the European legal framework. This, by the way, since Emannuel Macron's European speech, no longer seems such a distant perspective. European Council President Donald Tusk (Poland, EPP) has called a special euro area summit on 15 December when the completion of the banking union and the future of the euro area at large will be discussed. A week earlier (December 6), the Commission will present a legislative package on the deepening of euro area integration.

Farewell, Schaeuble, we will miss you!

The October Eurogroup passed with a high emotional charge because it was the last for German Finance Minister Wolfgang Schaeuble. His remarkable intellect and straightforwardness have turned into one of the Eurogroup's blazons during his 8 years participation. Not a single participant in the meeting was short of praises for the minister who often caused sparks along the north-south axis demanding adherence to strict budgetary discipline and his strong allergy to inefficiency. In the words of Eurogroup chief Jeroen Dijsselbloem, it is a myth that Wolfgang Schaeuble had a dominant position in the Eurogroup because Germany is dominant.

"Germany is a large country, but I think that is completely misunderstanding his position and the authority that he has among us, the colleagues. This has to do with his experience, but also his wisdom and his strong focus on the European interest. I've always been convinced, even in the toughest discussions that we had in the Eurogroup in the five years that I was involved, that he always put the long term interest of a strong and stable Eurozone first".

Economic and Financial Affairs Commissioner Pierre Moscovici (France, S&D) was even more emotional. "He'd played a decisive part in his 8 yrs in the Eurogroup. Eurogroup from advisory has become operational thanks to a large extent to his leadership. I think that Europe and Germany will continue to need him".

Dijsselbloem is staying

Another important piece of news from the October 9 meeting is that Jeroen Dijsselbloem will remain as head of the Eurogroup until the end of his term (January 15). His case is a precedent because, under the rules the Eurogroup, the president must be an acting finance minister too. After the Dutch Labour party, which Mr Dijsselbloem is part of, lost devastatingly at the parliamentary elections this year, this brought the issue what to do with his leadership. As the negotiations on forming a new government in the Netherlands took a lot of time and just now their end can be seen, Dijsselbloem remained on his post.

Despite the reluctance of the emerging new government in the Netherlands, Dijsselbloem received unanimous support from his colleagues to remain president although he will no longer be a finance minister. It is not yet clear what are his plans for the future after his term expires. One of the ideas for the future of the euro area is to create a minister of finance for zone who will be both a member of the Commission and a Eurogroup chief. The future of the group caused a conflict between Pierre Moscovici and Jeroen Dijsselbloem, which even surfaced publicly during the September Eurogroup meeting in Estonia.

The reason for the conflict was a remark by the commissioner that the Eurogroup must become more transparent. "The issue is about democracy. In my view, democracy is about democratic accountability, that means that you have an executive that means that you have leadership, that means you have a debate, and that you have control. And I must say that this is not fully the case of the  Eurogroup", Moscovici said. According to him, the solution is precisely in creating an euro area finance minister who will be under the European Parliament's control.

Eurogroup", Moscovici said. According to him, the solution is precisely in creating an euro area finance minister who will be under the European Parliament's control.

Jeroen Dijsselbloem disagreed entirely. According to him, a lot has been done in the past years (by him) to make the work of the Eurogroup more transparent. He is regularly appearing at hearings in the European Parliament, without being obliged to do it. Dijsselbloem defended work behind closed doors in the Eurogroup because, according to him, this helps a lot when tough decisions are being taken. "The Eurogroup is an intergovernmental body. It's an informal group, it's an informal meeting of the ministers of finance. What I simply do not agree with - and this, I think is, indeed, a matter of difference of opinion - that intergovernmental cooperation between ministers is not democratic. To that I have strong objections. My parliament and many parliaments in [the] eurozone scrutinise our work - the legal sides of it, the financial sides of it and certainly the political sides of it", he added.

Despite these differences, Pierre Moscovici praised Jeroen Dijsselbloem's work on Monday saying that he is a wonderful president of the Eurogroup.

Angela Merkel, Emmanuel Macron | © Council of the EU

Angela Merkel, Emmanuel Macron | © Council of the EU Benoit Coeure | © Council of the EU

Benoit Coeure | © Council of the EU Pierre Moscovici | © Council of the EU

Pierre Moscovici | © Council of the EU Elke Koenig | © European Commission

Elke Koenig | © European Commission | © European Commission

| © European Commission | © European Parliament

| © European Parliament