Eurozone and Greece Are Preparing for Bailout Exit

Adelina Marini, October 5, 2017

A very important piece of news has passed almost unnoticed last week among crucial for the EU issues, like the situation with the rule of law in Poland, the election in Germany and what ruling coalition will be formed at a time when the eurozone is ready to make a giant leap forward in its integration, the going nowhere Brexit negotiations and the accelerated legislative activity of the European Commission. But the most important news last week was that Greece has exited the excessive deficit procedure, thus getting another step closer to the end of its third bailout programme.

A very important piece of news has passed almost unnoticed last week among crucial for the EU issues, like the situation with the rule of law in Poland, the election in Germany and what ruling coalition will be formed at a time when the eurozone is ready to make a giant leap forward in its integration, the going nowhere Brexit negotiations and the accelerated legislative activity of the European Commission. But the most important news last week was that Greece has exited the excessive deficit procedure, thus getting another step closer to the end of its third bailout programme.

The significance of the decision of the foreign and European affairs ministers of 25 September is huge if we recall that Greece was in the excessive deficit procedure for 8 years. In 2009, the Greek shortage in the budget was gigantic - 15.1% of gross domestic product. Last year, for the first time, the country registered a primary surplus (without the interest rates on loans) of 0.7%, much bigger than forecast. The European Commission projects a small deficit this year but it will be much below the 3% ceiling under the European fiscal rules.

Greece's huge budget deficit and the manipulated statistical data marked the beginning of the euro area's biggest crisis since the introduction of the single currency, a crisis that unleashed a domino effect and created a risk of a breakup of the currency club and even of the European Union. From the moment the Greek government requested financial assistance from its partners in the spring of 2010, Greece turned into a top priority for the EU and especially for the euro area. Hundreds of emergency meetings, sleepless nights, compromises unheard of, exchange of harsh words, billions of euros, snap elections, referenda, resignations, writing of tens of books is the balance from the Greek crisis, which is entering its last phase.

This year, undoubtedly, will remain in history as the first when the light in the end of the tunnel can finally be seen. The implementation of the third adjustment programme is on track. The biggest problem continues to be the disagreement between the euro area and the International Monetary Fund on the issue of the sustainability of the Greek public debt and that is the only condition for the financial involvement of the Fund in the third rescue package. The way things stand right now it is not even necessary but it does play the role of a bad cop at the moment to keep the direction and the dynamics of programme implementation. As EU Economic and Financial Affairs Commissioner Pierre Moscovici (France, S&D) announced after the Eurogroup's informal meeting in September in Estonia, the successful conclusion of the third bailout programme will be a signal that a very difficult chapter in the history of the eurozone is to be closed.

Work has already started on the third review of the third package, as the ambition is to complete it by the end of the year. Greece is expected to complete 95 measures linked to social benefits, labour market reform, reform of the public administration, implementation of the non-performing loans strategy, reform of the energy sector and privatisation. According to Pierre Moscovici, the tasks are not easy but their timely implementation will be a signal that Greece has returned as a full member of the euro area.

Is there life after the bailout programme?

This turning point was reached in June this year when a huge breakthrough has been reached - the Eurogroup made a much more specific commitment to Greece for the period after it exits the programme in August next year - for the price of compromises from both sides. Greece committed to maintain a primary budget surplus of 3.5% of its GDP by 2022, and after that a fiscal trajectory of around 2% of GDP from 2023 until 2060. The Eurogroup's expectations are that Greece's financial needs (to service debt) will remain below 15% of GDP in the mid-term and below 20% after that, which is a condition to keep the Greek public debt sustainable. The size of Greece's debt in 2016 peaked at 179.0% of GDP.

This turning point was reached in June this year when a huge breakthrough has been reached - the Eurogroup made a much more specific commitment to Greece for the period after it exits the programme in August next year - for the price of compromises from both sides. Greece committed to maintain a primary budget surplus of 3.5% of its GDP by 2022, and after that a fiscal trajectory of around 2% of GDP from 2023 until 2060. The Eurogroup's expectations are that Greece's financial needs (to service debt) will remain below 15% of GDP in the mid-term and below 20% after that, which is a condition to keep the Greek public debt sustainable. The size of Greece's debt in 2016 peaked at 179.0% of GDP.

In exchange for Athens' good and responsible behaviour, the Eurogroup, which after the payment of the latest tranche of 8.5 bn euros in July is now the owner of 50% of Greece's debt, committed to extend maturities on loans and to further reduce the interest rates of the first bailout programme, financed by the EFSF. In case there are deviations from the forecasts the Eurogroup stands ready to trigger a protection mechanism, the details of which will be elaborated after the successful completion of the programme, when it will be clearer whether forecasts are right.

George Chouliarakis, Alternate Minister of Finance and Chairman of the Council of Economic Advisers of Greece, said after the June Eurogroup that for the first time there is clarity on Greece's future after the end of the programme. The agreed debt relief package is three-layered, he explained. The first layer are the specific mid-term measures, the second is the mechanism that will be triggered in cases when economic growth is below expectations, and the third are the long-term debt relief measures.

Despite the agreement, IMF remained unhappy. At the same meeting on June 15 in Luxembourg, the Fund's chief, Christine Lagarde, admitted that a lot had been achieved but it was still not enough to ensure the Fund's involvement in the financial package. However, Mrs Lagarde demonstrated good will by committing that the IMF will set money aside which will be paid after the Fund's requirements are met. In July, the IMF executive board approved a stand-by agreement of 1.6 bn euros, which will be paid when the Fund receives assurances from its European partners about the sustainability of Greece's debt and if the economic programme is implemented. The IMF wants more to be done to relieve the Greek debt which the organisation still considers not sustainable.

Greece and the future of the euro area

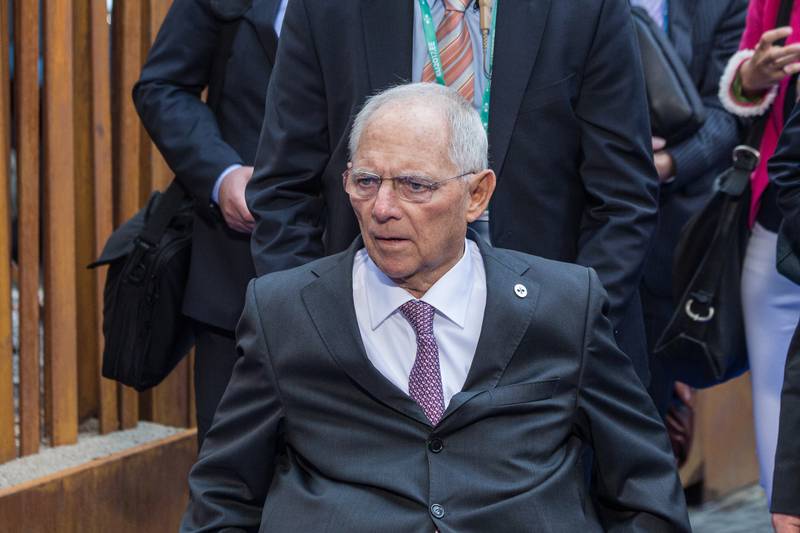

It was German Finance Minister Wolfgang Schaeuble who mostly insisted on IMF's involvement. This was his condition to sign the third adjustment programme. However, after the election in Germany he is now out of the game. This still does not mean that Berlin will completely lift its objections, but given the change of atmosphere in the euro area after the election of Emmanuel Macron for president of France, the focus has shifted on the deepening of the euro area integration. One of the ideas in the reflection paper the European Commission published in the spring is the creation of a European Monetary Fund. All bailout funds will be better integrated and expanded, which means that the bailout  out of troubled economies in the euro area will remain an internal eurozone matter and there will be no need of an external organisation like the IMF.

out of troubled economies in the euro area will remain an internal eurozone matter and there will be no need of an external organisation like the IMF.

For this to happen however, it is still important Greece to continue in the same spirit of constructivity, maturity and sobriety, which will restore trust between members of the currency club and will encourage them to get closer together. But Greece is still giving reasons for concern. At the September Eurogroup meeting, ministers expressed concern with the rule of law in Greece after the former chief of the Greek statistics office, Elstat, was sentenced to two years in prison on a charge of abuse of position. Andreas Georgiou was found guilty for not informing the board of directors of Elstat for his decision to revise the 2009 deficit data.

"We fully respect the independence of the judicial system but we see also that these cases create reputation damage and could, if no solution is found, damage the return of the confidence among investors", said Commissioner Moscovici. The president of the European Stability Mechanism (the permanent bailout fund of the euro area), Klaus Regling, also warned that the legal issues affect the financial markets. All this is happening at a time when the credit rating agencies have increased their expectations for Greece and also when he country has made a successful attempt to return on the market.

Until the third bailout programme is implemented, the IMF will continue to play the role of a life-belt, which will secure the eurozone more time to start the new integration wave. At the autumn EU summit in two weeks, it is expected that plans for the future of the euro area will be discussed in more detail, and the European Commission will present on December 6 the first legislative proposals. Unless there is some new political or economic cataclysm, the Greek story will remain in the past as that necessary evil which triggered the completion of the euro area, the very creation of which is a series of small steps and a lot of distrust among the member states.

Klaus Regling | © Council of the EU

Klaus Regling | © Council of the EU Mario Centeno | © Council of the EU

Mario Centeno | © Council of the EU Mario Centeno | © Council of the EU

Mario Centeno | © Council of the EU