Mario Draghi | © ECB

Mario Draghi | © ECBThere are two pieces of news from the June meeting of the Governing Council of the European Central Bank. The first is that the bank took a step towards tightening monetary policy. The second is that serious changes will not occur until basic inflation remains a straight line. There is ...

Vladislav Goranov, Sven Sester | © Council of the EU

Vladislav Goranov, Sven Sester | © Council of the EUWith an agreement in principle, but with a lot of worries and hesitations ended the second discussion in the Council of EU finance ministers on the revived European Commission proposal to introduce a Common Consolidated Corporate Tax Base (CCCTB). Last October, the Commission tried to ...

Tsakalotos, Djisselbloem, Gramegna | © Council of the EU

Tsakalotos, Djisselbloem, Gramegna | © Council of the EUThe European Commission is making a second attempt at implementing a common consolidated corporate tax base (CCCTB) after the previous attempt in 2011 failed. Chances of success are not too big this time either, but the Commission relies on the new approach towards one of the most cont ...

Edward Scicluna | © Council of EU

Edward Scicluna | © Council of EURight at the start of the presentation of the package on fighting tax avoidance by multinational companies European Commissioner for tax affairs Pierre Moscovici (France, Socialists and Democrats) forecasted that discussions on it will not be easy. During the debates in the European Pa ...

Pierre Moscovici | © European Commission

Pierre Moscovici | © European CommissionAt least this is the goal – member states safeguarding their social models by preventing trans-border operating multinational companies from avoiding “their fair share” of the tax burden. According to the European Commission, small and medium-sized enterprises in the EU pa ...

Jeroen Dijsselboem, Pierre Gramegna | © Council of the EU

Jeroen Dijsselboem, Pierre Gramegna | © Council of the EURegardless of the slow pace and multiple differences and despite losing a member, the group backing the Financial Transaction Tax (FTT) made progress during the ministers of finances’ meeting on December 8th. The main features of the future legislation under an enhanced cooperation procedu ...

Danuta Huebner | © European Parliament

Danuta Huebner | © European ParliamentOne year after the breakout of the “Lux Leaks” scandal the term of the special European Parliament committee, created to investigate this and other cases, draws to an end, but there still is no unequivocal answer to the question whether its work has been successful. Accordi ...

| © Luxembourg Presidency

| © Luxembourg PresidencyEurope’s stiff-neckedness is difficult to cure. To come to an agreement for supranational treatment of a certain issue there needs to be a large cataclysm or at least a large scandal. In the case of taxation policy the problem begins to gain urgent and most importantly European status afte ...

Jean-Claude Juncker | © European Commission

Jean-Claude Juncker | © European CommissionThe LuxLeaks scandal is a classical example of the growingly frequent clash between the level of integration of the European economy (and the global for that matter) and the national sovereignty. Greece was first to prove that four years ago when it put to the test the very survival of the euro ...

Fabrizio Saccomanni, Kalin Hristov | © Council of the EU

Fabrizio Saccomanni, Kalin Hristov | © Council of the EUOne of the big lessons from the crisis in Europe that was not spoken of sufficiently is that in the very beginning the wrong approach was chosen - first individual rescue and then seeking a EU solution. Some countries rushed to rescue their collapsing banking sectors, others were pushed to do so ...

| © EU

| © EUThe crisis was the reason for urgent development of policies and reforms to tackle its evolution and its negative effects, and to protect the countries from another set of similar events. "Four years later, with banking woes ongoing in various parts of the world (most notably in the euro area), ...

| © EU

| © EUThere could have hardly been more appropriate/inappropriate timing for the publication of the ideas of the European Commission for banking resolution than an inflaming by the hour banking crisis in Europe. Spain is on the edge of asking the EU to bailout its ailing banks, which still cannot over ...

| © European Union

| © European Union16 of the biggest investment banks in the world and a company for financial information are a subject of antitrust investigation by the European Commission. Among the investigated banks are names like JP Morgan, BNP Paribas, Deutsche Bank, Goldman Sachs, HSBC, Morgan Stanley, Royal Bank of Scotl ...

| © European Parliament- Audiovisual Service

| © European Parliament- Audiovisual ServiceThe European Parliament has approved the new structure of the European financial supervision. The new supervisory authorities have become a fact after the EU institutions finally reached a compromise on the controversial issues that have for a long time delayed the adoption of the legislative pa ...

| © www.bis.org

| © www.bis.orgA significant tightening of the existing capital requirements of banks has been approved on September 12 by the supervisory body of the Basel Committee for Banks Supervision* - the Group of Governors and Heads of Supervision. The capital reforms, together with the introduction of a global liquid ...

| © European Parliament- Audiovisual Service

| © European Parliament- Audiovisual ServiceAfter the "Madrid compromise" on the European diplomatic service, the European "trinity" (the Commission, the Parliament and the Council) have reached a new major breakthrough - on financial supervision. The topic is on the agenda for more than a year, but differences in the positions of the thr ...

| © The White House

| © The White HouseQuite quickly and with a surprising majority the US Senate approved the American Financial System Reform bill, right after the same did the House of Representative in the American Congress. This week President Barack Obama will sign it into Act, thus keeping another pre-election promise just a y ...

| © The Council of the European Union

| © The Council of the European UnionGreat Britain announced the introduction of a new bank levy to be enforced from the next year. The measure is included in the draft budget for 2011 presented on Monday (21 June 2010) by the Chancellor of the Exchequer George Osborne.

According to the official statement, the levy will be based on ...

| © The Council of the European Union

| © The Council of the European UnionThe G20 finance ministers warned of the need for urgent measures to reduce the large budget deficits, which, according to them, is now a number one problem in global financial agenda. However, the controversial decision to impose a levy on banks will be left to national governments.

In the final ...

| © euinside

| © euinsideThe taxpayers have saved the banks, now the banks have to pay their contribution to the common good.

If I hadn't heard with my own ears the president of the European Commission say that, I would have thought that these words belonged to Ugo Chavez. Or at least to Nicolas Sarkozy. But this positi ...

| © Eropean Commisson-Audiovisual Service

| © Eropean Commisson-Audiovisual ServiceIt is not a problem a bank to fail. The question is how this should be done without a severe impact on the system. This lesson from the crisis is at the heart of the European Commission's proposal for the establishment of special resolution funds in order to organize the bankruptcy of financial ...

| © The White House

| © The White HouseBulgarian Prime Minister Boyko Borissov who adores success and victories, should get inspired by the achievements of president Barack Obama, whom Mr Borissov liked very much in Prague. The reason is that a year and a half from the beginning of his term Barack Obama already has some serious legis ...

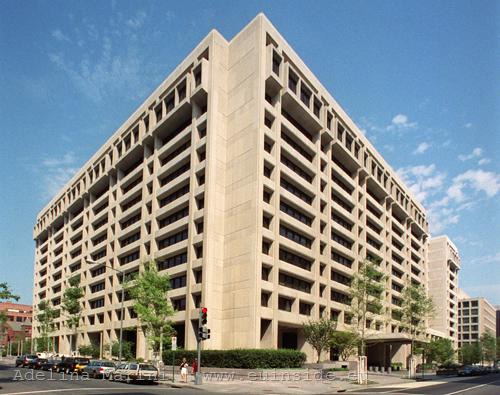

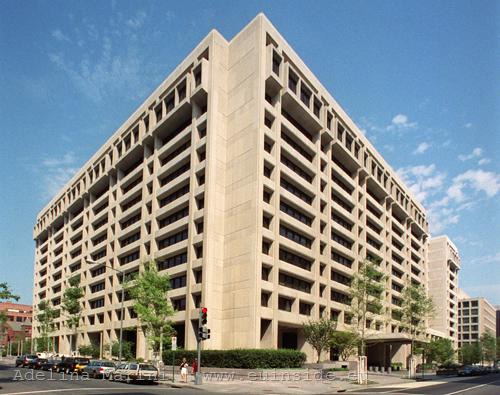

| © Adelina Marini | www.euinside.eu

| © Adelina Marini | www.euinside.euThe G20 finance ministers discussed but did not approve IMF's proposal for the introduction of global bank levies. "The apple of discord" is the thesis that financial institutions are to blame for the crisis and they should return the gesture to taxpayers, who carry the burden of rescue measures ...

| © Adelina Marini | www.euinside.eu

| © Adelina Marini | www.euinside.euFinancial institutions are threatened to pay dearly for the crisis if politicians go all the way in seeking revenge on behalf of taxpayers. This is getting clear from a confidential report of the International Monetary Fund (IMF), published by the BBC News upon a request of the G20 leaders for t ...

| © US Department of the Treasury

| © US Department of the TreasuryHowever there is a big difference in whether mistakes are caused by firm beliefs or by incompetence. Bulgaria, unfortunately, has still not learned to learn from its mistakes, no matter its pretenses to be a thousand years old state. Unlike the US, who at a first glance, demonstrate readiness to ...

| © European Council

| © European CouncilThe Swedish presidency again called on EU member states to take all necessary actions to ensure an agreement for the establishment of a micro financial supervision body. After today's ECOFIN Council the Swedish finance minister vigorously warned that by the December session of ECOFIN there must ...

| © null

| © nullA little after the reports for a beginning of the end of the recession, fears rose that because of the good economic outlooks for improvement of the global economy and that of the US, in particular, it is possible the plans for tightened regulation to be abandoned. Those plans were one of the fi ...

| © Audiovisual service

| © Audiovisual serviceJust 2 days remain until the G20 summit in Pittsburgh, the US, but will the expectations for finding a solution to 2 of the most pressing global problems, will come up? The reason for the lack of clarity on this issue is that these 2 most pressing issues are so complex that the need for their ur ...

| © Italian Presidency of the G8

| © Italian Presidency of the G8There are some signs of stabilisation of the economy but this doesn't mean that we have to comfort ourselves, agreed the leaders of world's leading economies at their summit in the Italian town of L"Acquila, symbolizing the crushed grandeur by the disastrous earthquake in April that killed some ...

| © G8 host

| © G8 hostThe lack of counter-cyclical buffers and flexibility of the accounting rules are important factors for the amplification of the financial crisis. This is one of the conclusions of the EU finance ministers who gathered in Brussels on Tuesday to form their position before the G-8 summit today in L ...

Today will be the first meeting of ECOFIN under Swedish Presidency. The main issue will be the preparation for some forthcoming meetings in the G-20 format. The first will be the G-20 financial ministers meeting which will precede the G-20 summit in Pittsburgh in September. The Council is also e ...

| © Audiovisual service

| © Audiovisual serviceSweden is against the increase of financial regulation so that it could cover the hedge funds and private equity sectors. During the presentation of the Swedish Presidency priorities, which started on the 1st of July, the minister of finance Mats Odell said that those financial organisations are ...

| © Consilium

| © Consilium6 months after he came in office, president Barack Obama already announced his latest plan, of at least 5 (related to the financial an economic crisis), for a new financial architecture in the US and the EU managed on Friday to reach an agreement on the Commission communication fr a new form of ...

| © euinside

| © euinsideA great increase of the power of the Federal Reserve as well as stronger and more consistent oversight of the largest financial firms. This is one of the 5 pillars in the long expected plan of the Obama administration to increase the state interference in private markets. The plan is to be prese ...

Bulgaria has generally supported the conclusions of the Council of finance ministers - ECOFIN, the Bulgarian representation to the EU reported in response to a question of euinside. The conclusions generally correspond to the Bulgarian positions after some remarks have been taken into account. T ...

| © European Council archive

| © European Council archiveThe new supervisory system on banking, insurance and securities markets will be discussed at ECOFIN today. The Communication which the Commission formulated officially almost 2 weeks ago, is based upon the de Larosiere report, presented in February, which requires stricter control over the banki ...

| © CER

| © CERThe latest proposal of the European Commission for a European supervisory structure is an attempt to reach a compromise between those who are pressing for a single European regulator and those who think that supervision needs to continue to be carried out in individual member states. This is wha ...

| © Audiovisual Service

| © Audiovisual ServiceThe EU and the US are going to obvious centralisation of bank supervision after it was reported that Washington is considering the creation of a one and only agency that would regulate the banking industry and will replace the net of agencies that have failed to prevent the worst financial crisi ...

| © Audiovisual Service

| © Audiovisual ServiceA new European Systemic Risk Council (ESRC) and European System of Financial Supervisors (ESFS) is only part of the Communication the European Commission approved today for the establishment of new Financial supervision in Europe. The Communication is actually a set of ambitious reforms to the c ...

The latest topic in the series of "Financial times" newspaper is about aid and how useful it is to aide financially developing countries, especially in moments of crisis. The reason for the discussion in the blog section of the paper was the book of a Zambian economist Dambisa Moyo, "Dead Aid" i ...

Against the background of the discussions about quick economic recovery as well as the academic disputes about the roots of the crisis, in Washington is being held a discussion about the establishment of a regulatory commission that would have broad authority to protect consumers who use financi ...

An interesting discussion about the roots of the crises was held in Sofia today in the framework of an academic meeting about "The crises and Bulgaria - a view from the past". The Bulgarian minister of finance Plamen Oresharski took part in the discussion together with the financial expert Emil ...

Mario Draghi | © ECB

Mario Draghi | © ECB Vladislav Goranov, Sven Sester | © Council of the EU

Vladislav Goranov, Sven Sester | © Council of the EU Tsakalotos, Djisselbloem, Gramegna | © Council of the EU

Tsakalotos, Djisselbloem, Gramegna | © Council of the EU Edward Scicluna | © Council of EU

Edward Scicluna | © Council of EU Pierre Moscovici | © European Commission

Pierre Moscovici | © European Commission Jeroen Dijsselboem, Pierre Gramegna | © Council of the EU

Jeroen Dijsselboem, Pierre Gramegna | © Council of the EU Danuta Huebner | © European Parliament

Danuta Huebner | © European Parliament | © Luxembourg Presidency

| © Luxembourg Presidency Jean-Claude Juncker | © European Commission

Jean-Claude Juncker | © European Commission Fabrizio Saccomanni, Kalin Hristov | © Council of the EU

Fabrizio Saccomanni, Kalin Hristov | © Council of the EU | © EU

| © EU | © EU

| © EU | © European Union

| © European Union | © European Parliament- Audiovisual Service

| © European Parliament- Audiovisual Service | © www.bis.org

| © www.bis.org | © European Parliament- Audiovisual Service

| © European Parliament- Audiovisual Service | © The White House

| © The White House | © The Council of the European Union

| © The Council of the European Union | © The Council of the European Union

| © The Council of the European Union | © euinside

| © euinside | © Eropean Commisson-Audiovisual Service

| © Eropean Commisson-Audiovisual Service | © The White House

| © The White House | © Adelina Marini | www.euinside.eu

| © Adelina Marini | www.euinside.eu | © Adelina Marini | www.euinside.eu

| © Adelina Marini | www.euinside.eu | © US Department of the Treasury

| © US Department of the Treasury | © European Council

| © European Council | © null

| © null | © Audiovisual service

| © Audiovisual service | © Italian Presidency of the G8

| © Italian Presidency of the G8 | © G8 host

| © G8 host | © Audiovisual service

| © Audiovisual service | © Consilium

| © Consilium | © euinside

| © euinside | © European Council archive

| © European Council archive | © CER

| © CER | © Audiovisual Service

| © Audiovisual Service | © Audiovisual Service

| © Audiovisual Service