Impressive market debut of the euro area rescue fund

Ralitsa Kovacheva, January 26, 2011

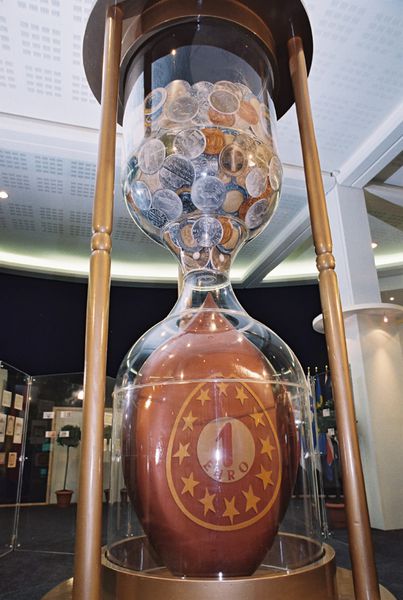

The euro area rescue fund (the European Financial Stability Facility, EFSF) debuted strongly on the financial markets. Its first ever bond issue reaped stormy investors' interest, as the data published by the Financial Times show. Against the background of the planned issue worth 5 billion euro, the orders for the auction reached 40 billion euro. Bidders told the newspaper that such a demand was never registered before on any bond, whether governmental or corporate. The Fund's bonds have a triple A rating and are guaranteed by the eurozone countries, which makes them a profitable and safe investment.

The euro area rescue fund (the European Financial Stability Facility, EFSF) debuted strongly on the financial markets. Its first ever bond issue reaped stormy investors' interest, as the data published by the Financial Times show. Against the background of the planned issue worth 5 billion euro, the orders for the auction reached 40 billion euro. Bidders told the newspaper that such a demand was never registered before on any bond, whether governmental or corporate. The Fund's bonds have a triple A rating and are guaranteed by the eurozone countries, which makes them a profitable and safe investment.

This is a powerful signal of investors' confidence in the eurozone, at a time when it is far from the perfect balance because of the problems in certain Member States. But while the confidence in Greece and Ireland has been strongly shaken, obviously it has not affected the EFSF's bond issues. These are guaranteed by the eurozone countries and especially Germany, which is still a measure of stability. Perhaps the success of the EFSF's first bound issue will be used by supporters of the idea to create Eurobonds as an argument, that the proposal is profitable and will be well accepted by the markets.

Good news for Spain too from the financial markets - Madrid traded treasury bills worth 2.2 billion euro with a significantly lower yield than in a similar auction in December 2010, which showed an improved investors' attitude, the FT commented. European officials repeatedly said that they had full confidence in the actions of the Spanish authorities to tackle the financial problems of the country, including with regard to the troubled savings banks.

Meanwhile in Brussels, changes in size and scope of the European rescue fund have been discussed. EurActiv reported that a working group was created for the purpose, composed of experts and lawyers from Member States' finance ministries. According to the medium, the secrecy surrounding the working group is so deep that practically it does not exist officially. According to an unofficial EU source, quoted by the medium, the group's agenda was being determined by Germany.

Among the ideas discussed under Berlin's pressure was binding the permanent rescue fund with more stringent tax and debt rules. According to a European diplomat, Germany would require as a precondition for the increase of the rescue fund all member states to follow Germany’s example and impose constitutionally bound debt brakes.

During the debate on a confidence vote to the Bulgarian government on January 20, Deputy PM and Finance Minister Simeon Djankov (Dyankov) said the government was considering introducing a statutory limit on budget deficit. He explained that the government was working on a package of laws and legal changes to ensure the inviolability of the financial discipline and as a consequence - the economic stability in the long run.

Another common idea of France, Germany and the European Commission is binding the loans from the bailout fund with tighter fiscal rules, in particular with respect to corporate taxes. This is a particularly sore issue for Ireland, whose corporate tax of 12.5% was a thorn in the eyes of eurozone countries. During the negotiations for a rescue loan from the EU and the IMF Dublin was under strong pressure to increase its corporate tax, but the government did not back down and even noted in its 4-year budgetary strategy that the corporate tax would not be increased under any circumstances.

How far the negotiations between the Member States have reached on the controversial issues we’ll see as early as February 4, when EU leaders are to gather for their first European Council for this year. European Commission President Jose Manuel Barroso said unequivocally that he expected leaders to decide then as to increase the financial capacity of the rescue fund, as well as to widen the scope of its activities.

| © www.primeminister.gov.gr

| © www.primeminister.gov.gr | © European Commission- Audiovisual Service

| © European Commission- Audiovisual Service | © The Council of the European Union

| © The Council of the European Union