Greece down the credit rating slide

Ralitsa Kovacheva, June 3, 2011

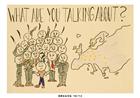

Greece has met the dawn with a consecutive downgrade of its credit rating - the Moody's rating agency has downgraded the Greek bonds form B1 to Caa1 with a negative outlook. The reasons are “the increased risk that Greece will fail to stabilise its debt position, without a debt restructuring” and “the increased likelihood that Greece's supporters (the IMF, ECB and the EU Commission, together known as the "Troika") will, at some point in the future, require the participation of private creditors in a debt restructuring as a precondition for funding support”. The agency assumes that the current negotiations between the Greek government and the Troika will result in an agreement for further financial support and additional austerity measures and structural reforms.

Greece has met the dawn with a consecutive downgrade of its credit rating - the Moody's rating agency has downgraded the Greek bonds form B1 to Caa1 with a negative outlook. The reasons are “the increased risk that Greece will fail to stabilise its debt position, without a debt restructuring” and “the increased likelihood that Greece's supporters (the IMF, ECB and the EU Commission, together known as the "Troika") will, at some point in the future, require the participation of private creditors in a debt restructuring as a precondition for funding support”. The agency assumes that the current negotiations between the Greek government and the Troika will result in an agreement for further financial support and additional austerity measures and structural reforms.

The Greek Ministry of Finance determined Moody's decision as a result “more by market rumours rather than objective facts,” because it had been taken before the Greek government to present its medium-term fiscal strategy and an updated Memorandum of Understanding to be agreed with the Troika.

The result of the IMF, the ECB and European Commission’s mission in Athens is  expected within days and the next payment on the Greek loan will depend on it. It is also expected a decision for an additional financial assistance to be made in exchange for new measures by the Greek government. The reason is that Greece has to return to the market place in 2012, but according to European Commissioner for Economic and Monetary Affairs Olli Rehn, “given the current risk premiums, a return to the markets is virtually impossible. For that reason, Greece will face some very tough decisions in the coming months.” (see his interview with Der Spiegel).

expected within days and the next payment on the Greek loan will depend on it. It is also expected a decision for an additional financial assistance to be made in exchange for new measures by the Greek government. The reason is that Greece has to return to the market place in 2012, but according to European Commissioner for Economic and Monetary Affairs Olli Rehn, “given the current risk premiums, a return to the markets is virtually impossible. For that reason, Greece will face some very tough decisions in the coming months.” (see his interview with Der Spiegel).

The European institutions continue to deny the possibility of a Greek debt restructuring (the Greek debt amounts to 150% of GDP), but it is possible to proceed with a roll-over of Greek bonds - replacing maturing securities with new bonds. The strongest opponent of a possible restructuring of the Greek debt is the European Central Bank, but the institution does not exclude a roll-over.

EU Commissioner Olli Rehn maintains that a potential debt restructuring “would have negative consequences for the Greek financial system and could trigger a chain reaction in the rest of Europe”, but it would not lead to a sustainable debt reduction. This can happen only if Greece achieved a budget surplus (at least 5%), for at least several consecutive years, as the Commissioner has explained to MEPs some time ago. The European leaders also deny the rumours that the IMF would refuse to participate in a further saving of Greece, because, as a rule, the institution provides funds only to countries with a sustainable debt.

EU Commissioner Olli Rehn maintains that a potential debt restructuring “would have negative consequences for the Greek financial system and could trigger a chain reaction in the rest of Europe”, but it would not lead to a sustainable debt reduction. This can happen only if Greece achieved a budget surplus (at least 5%), for at least several consecutive years, as the Commissioner has explained to MEPs some time ago. The European leaders also deny the rumours that the IMF would refuse to participate in a further saving of Greece, because, as a rule, the institution provides funds only to countries with a sustainable debt.

Meanwhile, there is an increasing pressure external experts to take control over the privatisation of Greek state assets (which is expected to bring revenues of 50 billion euros) and the tax collection, after it became clear that Greece had not fulfilled its commitments in these two areas. “Tax evasion was simply not pursued as successfully as would have been advisable,” Commissioner Olli Rehn told Der Spiegel. The same magazine quoted the President of the Eurogroup and Prime Minister of Luxembourg, Jean-Claude Juncker, saying that “Greece has not adequately implemented the consolidation program to which it had agreed. Revenues are 9 percent below the target, the reform of the tax system is not proceeding as agreed and the planned privatization efforts haven't even been initiated.”

Both say that the creation of a special privatization agency independent of the government is being considered, modeled after a German institution, which managed the privatisation of East Germany's state assets after the reunification. Some countries like the Netherlands and Luxembourg called for the privatisation and even the collection of taxes to be realised by foreign experts, this however cannot be done in a sovereign country, the spokesman of the Commissioner Rehn - Amadeu Altafaj-Tardio commented. Instead, the Commission is ready to offer “technical assistance” to Greece, like it did with the reform of the local statistical office.

The negotiations on a new agreement with the Troika are further hindered by the  failure of the Greek government to ensure a broad political support for its economic programme, which has been clearly stipulated by EU Commissioner Rehn. According to The Financial Times, the goal is a deal to be reached by June 20 when EU finance ministers gather in Brussels for their regular Council. Meanwhile, on June 6, Greece's debt crisis will be discussed in the Economy Committee in the European Parliament with EU Commissioner Olli Rehn and Eurogroup President Jean-Claude Juncker.

failure of the Greek government to ensure a broad political support for its economic programme, which has been clearly stipulated by EU Commissioner Rehn. According to The Financial Times, the goal is a deal to be reached by June 20 when EU finance ministers gather in Brussels for their regular Council. Meanwhile, on June 6, Greece's debt crisis will be discussed in the Economy Committee in the European Parliament with EU Commissioner Olli Rehn and Eurogroup President Jean-Claude Juncker.

Klaus Regling | © Council of the EU

Klaus Regling | © Council of the EU Mario Centeno | © Council of the EU

Mario Centeno | © Council of the EU Mario Centeno | © Council of the EU

Mario Centeno | © Council of the EU